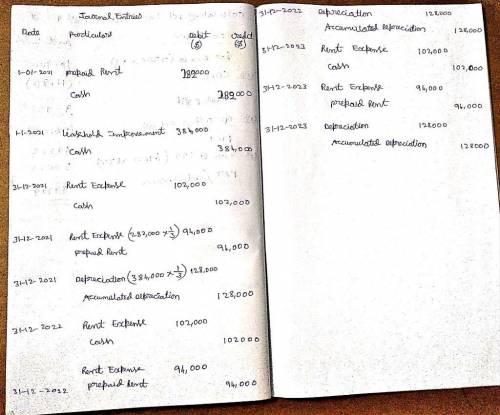

On January 1, 2021, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $102,000 each, beginning December 31, 2021, and at each December 31 through 2023. The lessor, HVAC Leasing calculates lease payments based on an annual interest rate of 8%. Winn also paid a $282,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $384,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2023. Winn's fiscal year is the calendar year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollars.) View transaction list Journal entry worksheet 2 3 4 5 6 7 8 11 Record the beginning of the lease for Winn.

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

In general, as long as the number of firms that possess a particular valuable resource or capability is less than the number of firms needed to generate perfect competition dynamics in an industry, that resource or capability can be considered and a potential source of competitive advantage.answers: valuablerareinimitableun-substitutable

Answers: 1

Business, 22.06.2019 11:20

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year.a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs.b. calculate the eoq.c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Business, 22.06.2019 16:40

Job applications give employers uniform information for all employees,making it easier to

Answers: 1

Business, 22.06.2019 19:30

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

You know the right answer?

On January 1, 2021, Winn Heat Transfer leased office space under a three-year operating lease agreem...

Questions

Law, 06.03.2021 01:00

Mathematics, 06.03.2021 01:00

Mathematics, 06.03.2021 01:00

Biology, 06.03.2021 01:00

Mathematics, 06.03.2021 01:00

Mathematics, 06.03.2021 01:00

Mathematics, 06.03.2021 01:00

Chemistry, 06.03.2021 01:00