Answers: 2

Another question on Business

Business, 22.06.2019 07:40

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 3

Business, 22.06.2019 16:40

Determine the hrm’s role in the performance management process and explain how to ensure the process aligns with the organization’s strategic plan.

Answers: 1

Business, 22.06.2019 17:50

On january 1, eastern college received $1,350,000 from its students for the spring semester that it recorded in unearned tuition and fees. the term spans four months beginning on january 2 and the college spreads the revenue evenly over the months of the term. assuming the college prepares adjustments monthly, what amount of tuition revenue should the college recognize on february 28?

Answers: 2

Business, 22.06.2019 20:00

Assume the perpetual inventory method is used. 1) the company purchased $12,500 of merchandise on account under terms 2/10, n/30. 2) the company returned $1,200 of merchandise to the supplier before payment was made. 3) the liability was paid within the discount period. 4) all of the merchandise purchased was sold for $18,800 cash. what effect will the return of merchandise to the supplier have on the accounting equation?

Answers: 2

You know the right answer?

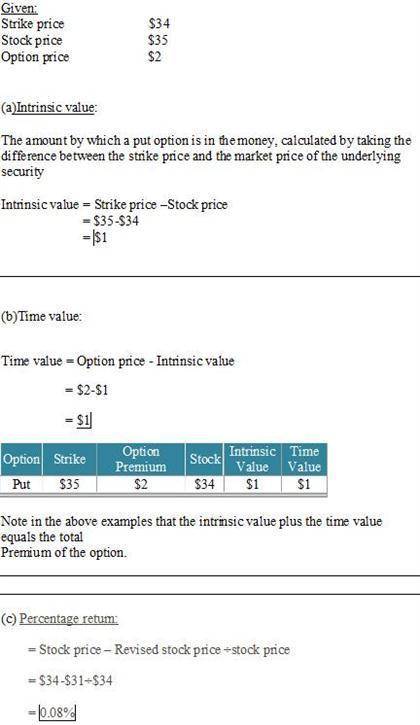

You buy a put option to sell stock at $35. The price of the stock is $34 when you bought it, and the...

Questions

Mathematics, 22.05.2021 05:40

Mathematics, 22.05.2021 05:40

English, 22.05.2021 05:40

Mathematics, 22.05.2021 05:40

History, 22.05.2021 05:40

Spanish, 22.05.2021 05:40

Health, 22.05.2021 05:40

History, 22.05.2021 05:40

English, 22.05.2021 05:40

English, 22.05.2021 05:40

Biology, 22.05.2021 05:40

English, 22.05.2021 05:40

Geography, 22.05.2021 05:40

Mathematics, 22.05.2021 05:40