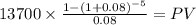

A manufacturing company has some existing semiautomatic production equipment that it is considering replacing. This equipment has a present MV of $55 comma 000 and a BV of $31 comma 500. It has five more years of depreciation available under MACRS (ADS) of $7 comma 000 per year for four years and $3 comma 500 in year five. (The original recovery period was nine years.) The estimated MV of the equipment five years from now is $18 comma 500. The total annual operating and maintenance expenses are averaging $26 comma 000 per year. New automated replacement equipment would then be leased. Estimated annual operating expenses for the new equipment are $12 comma 500 per year. The annual leasing costs would be $23 comma 900. The MARR (after taxes) is 8% per year, tequals40%, and the analysis period is five years. (Remember: The owner claims depreciation, and the leasing cost is an operating expense.) Based on an after-tax analysis, should the new equipment be leased? Base your answer on the IRR of the incremental cash flow.

Answers: 2

Another question on Business

Business, 22.06.2019 09:40

Boone brothers remodels homes and replaces windows. ace builders constructs new homes. if boone brothers considers expanding into new home construction, it should evaluate the expansion project using which one of the following as the required return for the project?

Answers: 1

Business, 22.06.2019 17:00

During which of the following phases of the business cycle does the real gdp fall? a. trough b. expansion c. contraction d. peak

Answers: 2

Business, 22.06.2019 20:40

If the ceo of a large, diversified, firm were filling out a fitness report on a division manager (i.e., "grading" the manager), which of the following situations would be likely to cause the manager to receive a better grade? in all cases, assume that other things are held constant.a. the division's basic earning power ratio is above the average of other firms in its industry.b. the division's total assets turnover ratio is below the average for other firms in its industry.c. the division's debt ratio is above the average for other firms in the industry.d. the division's inventory turnover is 6, whereas the average for its competitors is 8.e. the division's dso (days' sales outstanding) is 40, whereas the average for its competitors is 30.

Answers: 1

Business, 22.06.2019 23:10

Mbo works by objectives moving through the organization; that is, top managers set general organizational objectives, which are translated into divisional objectives, which are translated into departmental objectives. the hierarchy ends in individual objectives set by each employee. this is an example of mbo working as objectives through the organization.

Answers: 1

You know the right answer?

A manufacturing company has some existing semiautomatic production equipment that it is considering...

Questions

Social Studies, 25.08.2019 08:30

History, 25.08.2019 08:30

Mathematics, 25.08.2019 08:30

Mathematics, 25.08.2019 08:30

Physics, 25.08.2019 08:30

Social Studies, 25.08.2019 08:30

Health, 25.08.2019 08:30

Mathematics, 25.08.2019 08:30

History, 25.08.2019 08:30

Biology, 25.08.2019 08:30

![\left[\begin{array}{cccc}&New&Old&Differential\\$leasing cost&0&-23,000&23,000\\$operarting cost&-26,000&-12,500&-13,500\\$operating income&-26,000&-35,500&9,500\\$tax shield&4,200&0&4,200\\$Result&-21,800&-35,500&13,700\\\end{array}\right]](/tpl/images/0527/7383/308e6.png)