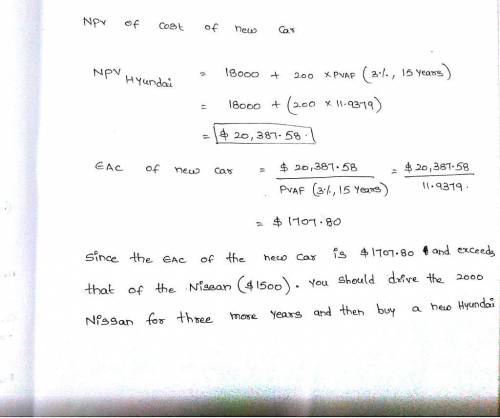

Replace an existing asset: You have a 2000 Nissan that is expected to run for another three years, but you are considering buying a new Hyundai before the Nissan wears out. You will donate the Nissan to Goodwill when you buy the new car. The annual maintenance cost is $1,500 per year for the Nissan and $200 for the Hyundai. The price of your favorite Hyundai model is $18,000, and it is expected to run for 15 years. Your opportunity cost of capital is 3 percent. Ignore taxes. When should you buy the new Hyundai?

Answers: 3

Another question on Business

Business, 22.06.2019 08:50

Comprehensive illustrative problem: mira's store on february 1 20a4 mica delaman opened astore that sells school supplies her main customer are the students and teachers of happy students school that is situated in front of her store. mira wanted to know the financial position of mira's store. mira knew you were studying accounting. so she asked for . 1. to start her business mira's opened a checking account in the name of mira's store . the statement of account from the bank shows that the checking account has a balance of 31,535 of december 31,20a4

Answers: 2

Business, 22.06.2019 14:30

What’s the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%? $4,750 $5,000 $5,250 $5,513 $5,788what is the present value of the following cash flow stream at a rate of 8.0%, rounded to the nearest dollar? cash flows: today (t = 0) it is $750, after one year (t = 1) it is $2,450, at t = 2 it is $3,175, and at t=3 it is $4,400. draw a time line. $7,917 $8,333 $8,772 $9,233 $9,695

Answers: 2

Business, 22.06.2019 20:10

Mikkelson corporation's stock had a required return of 12.50% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. then an increase in investor risk aversion caused the market risk premium to rise by 2%. the risk-free rate and the firm's beta remain unchanged. what is the company's new required rate of return? (hint: first calculate the beta, then find the required return.) do not round your intermediate calculations.

Answers: 2

You know the right answer?

Replace an existing asset: You have a 2000 Nissan that is expected to run for another three years, b...

Questions

Mathematics, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Social Studies, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Biology, 10.09.2020 02:01

History, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Computers and Technology, 10.09.2020 02:01