Business, 28.02.2020 01:53 mnknmklhnklnj2583

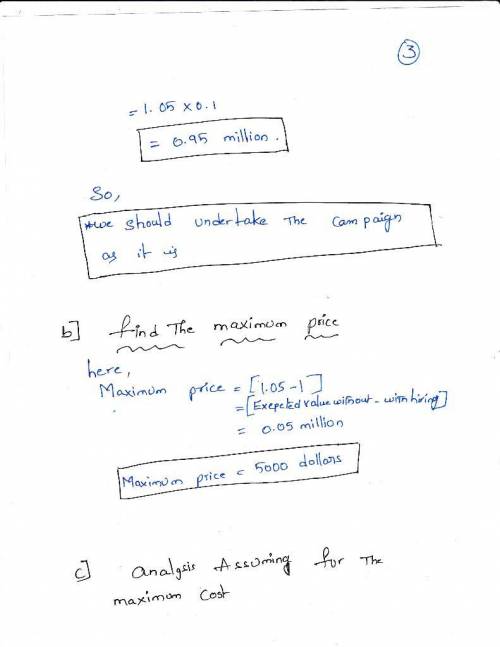

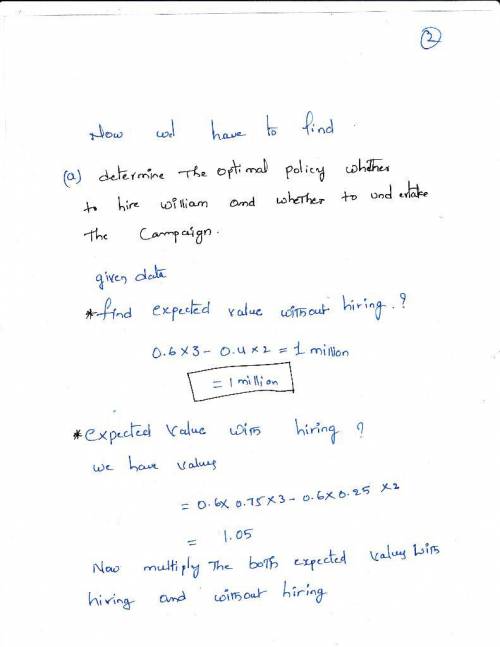

The Athletic Department of Leland University is considering whether to hold an extensive campaign next year to raise funds for a new athletic field. The response to the campaigın depends heavily upon the success of the football team this fall. In the past, the football team has had winning seasons 60 percent of the time. If the football team has a winning season (W) this fall, then many of the alumnae and alumni will contribute and the cam- paign will raise $3 milion. If the team has a losing season (L), few will contribute and the campaign will lose $2 million. If no campaign is undertaken, no costs are incurred. On September 1, just before the football season begins, the Athletic Department needs to make its decision about whether to hold the campaign next year.

(a) Develop a decision analysis formulation of this problem by identifying the alternative actions, the states of nature, and the payoff table.

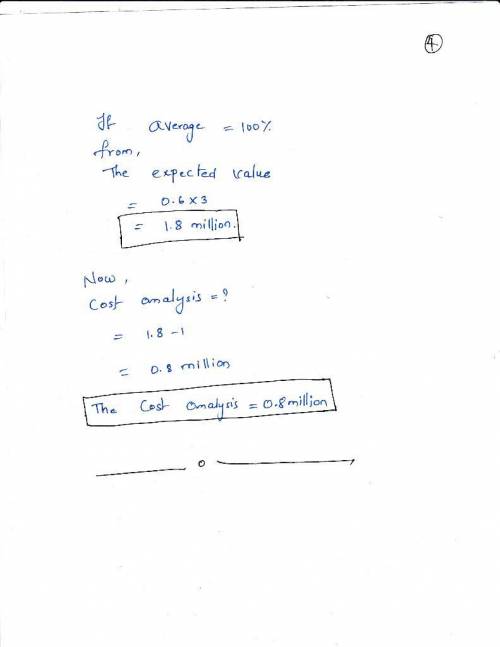

(b) According to Bayes’ decision rule, should the campaign be undertaken?

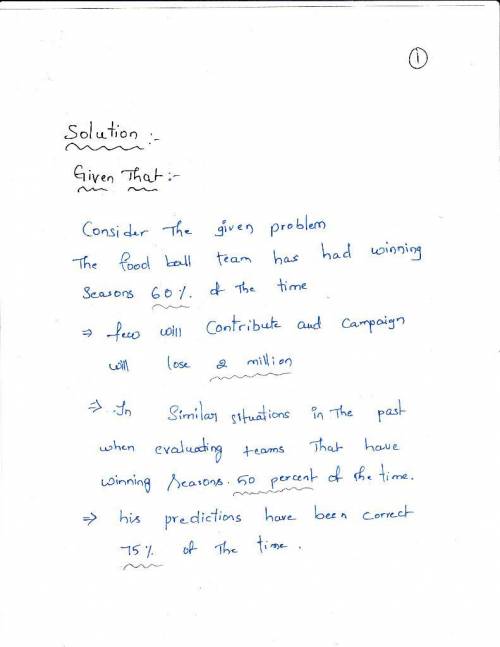

(c) What is EVPI?

Answers: 1

Another question on Business

Business, 21.06.2019 20:00

Jorge is a manager at starbucks. his operational plan includes achieving annual sales of $4,000,000 for his store. with only one month left to end of the fiscal year, jorge realizes that he won't reach his annual sales goal. what are his options?

Answers: 2

Business, 22.06.2019 01:20

What cylinder head operation is the technician performing in this figure?

Answers: 1

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

You know the right answer?

The Athletic Department of Leland University is considering whether to hold an extensive campaign ne...

Questions

Mathematics, 04.08.2021 22:40

Mathematics, 04.08.2021 22:40

Mathematics, 04.08.2021 22:40

Mathematics, 04.08.2021 22:40

Mathematics, 04.08.2021 22:40

Mathematics, 04.08.2021 22:40

Mathematics, 04.08.2021 22:40