Business, 27.02.2020 17:07 pedrozac81

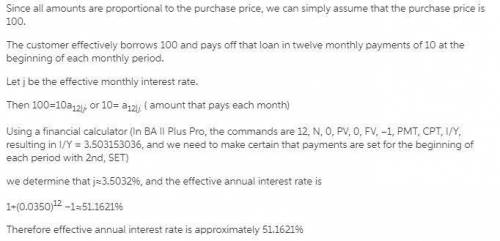

A discount electronics store advertises the following financing arrangement: ""We don’t offer you confusing interest rates. We’ll just divide your total cost by 10 and you can pay us that amount each month for a year."" The first payment is due on the date of sale and the remaining eleven payments at monthly intervals thereafter. Calculate the effective annual interest rate the store’s customers are paying on their loans.

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Which organization was established to train the hard-core unemployed? - better business bureau- equal employment opportunity commission- environmental protection agency- affirmative action committee- national alliance of business

Answers: 1

Business, 22.06.2019 11:10

Which of the following is an example of a production quota? a. the government sets an upper limit on the quantity that each dairy farmer can produce. b. the government sets a price floor in the market for dairy products. c. the government sets a lower limit on the quantity that each dairy farmer can produce. d. the government guarantees to buy a specified quantity of dairy products from farmers.

Answers: 2

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 19:10

The stock of grommet corporation, a u.s. company, is publicly traded, with no single shareholder owning more than 5 percent of its outstanding stock. grommet owns 95 percent of the outstanding stock of staple inc., also a u.s. company. staple owns 100 percent of the outstanding stock of clip corporation, a canadian company. grommet and clip each own 50 percent of the outstanding stock of fastener inc., a u.s. company. grommet and staple each own 50 percent of the outstanding stock of binder corporation, a u.s. company. which of these corporations form an affiliated group eligible to file a consolidated tax return?

Answers: 3

You know the right answer?

A discount electronics store advertises the following financing arrangement: ""We don’t offer you co...

Questions

Mathematics, 05.02.2021 16:20

Mathematics, 05.02.2021 16:20

Physics, 05.02.2021 16:20

Social Studies, 05.02.2021 16:20

Biology, 05.02.2021 16:20

Mathematics, 05.02.2021 16:20

Mathematics, 05.02.2021 16:20

Mathematics, 05.02.2021 16:20

Social Studies, 05.02.2021 16:20

Chemistry, 05.02.2021 16:20

Mathematics, 05.02.2021 16:20

Mathematics, 05.02.2021 16:20