Business, 22.02.2020 01:31 zamariahyou

Grafton Metalworks Company produces metal alloys from six different ores it mines. The company has an order from a customer to produce an alloy that contains four metals according to the following specications: at least 21% of metal A, no more than 12% of metal B, no more than 7% of metal C, and between 30% and 65% of metal D. The proportion of the four metals in each of the six ores and the level of impurities in each ore are provided in the following table:

Metal (%)

Ore - A - B - C - D - Impurities (%) - Cost/Ton

1 - 19 - 15 - 12 - 14 - 40 - $27

2 - 43 - 10 - 25 -7 - 15 - 25

3 - 17 - 0 - 0 - 53- 30 - 32

4 - 20 - 12 - 0 - 18 - 50 - 22

5 - 0 - 24- 10- 31 - 35 - 20

6 - 12 - 18 - 16 - 25 - 29 - 24

When the metals are processed and rened, the impurities are removed. The company wants to know the amount of each ore to use per ton of the alloy that will minimize the cost per ton of the alloy.

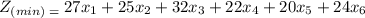

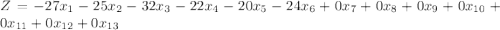

a. Formulate a linear programming model for this problem.

b. Solve the model by using the computer.

Answers: 3

Another question on Business

Business, 21.06.2019 20:20

If the government is required to balance the budget and the economy falls into a recession, which of the actions is a feasible policy response? cut taxes to encourage consumer spending invest in infrastructure increase government spending to stimulate the economy cut spending equal to the reduction in tax revenue what is a likely consequence of this policy? unemployment falls due to the economic stimulus. the negative consequences of the recession are magnified. consumer spending increases due to their ability to keep more of their after-tax income. there is hyperinflation due to an increase in aggregate demand.

Answers: 3

Business, 22.06.2019 08:40

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity.calculate the cost of new stock using the dividend growth approach.what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics.each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings.equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 14:00

How many months does the federal budget usually take to prepare

Answers: 1

Business, 23.06.2019 07:00

Choose all that apply. a financially-responsible person has a budget has no plan spends less than they make pays for everything with a credit card saves their money pays bills on time

Answers: 1

You know the right answer?

Grafton Metalworks Company produces metal alloys from six different ores it mines. The company has a...

Questions

Social Studies, 15.01.2021 07:00

Mathematics, 15.01.2021 07:00

History, 15.01.2021 07:00

Mathematics, 15.01.2021 07:00

Mathematics, 15.01.2021 07:00

Mathematics, 15.01.2021 07:00

Social Studies, 15.01.2021 07:00

Mathematics, 15.01.2021 07:00

Mathematics, 15.01.2021 07:00

Arts, 15.01.2021 07:00

Biology, 15.01.2021 07:00

Mathematics, 15.01.2021 07:00

be the 6 ores. The constraints will be as follows:

be the 6 ores. The constraints will be as follows:

and the artificial variable

and the artificial variable  .

.

.

.

.

.

and the artificial variable

and the artificial variable  .

.

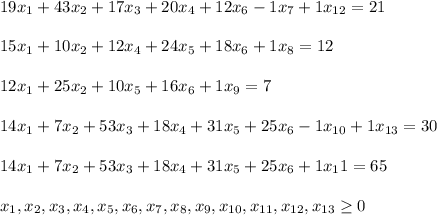

= 0

= 0

= 0.2792

= 0.2792 = 0.5292

= 0.5292 = 0

= 0

= 0

= 0

= 0

= 0