Business, 21.02.2020 05:28 babyboogrocks5695

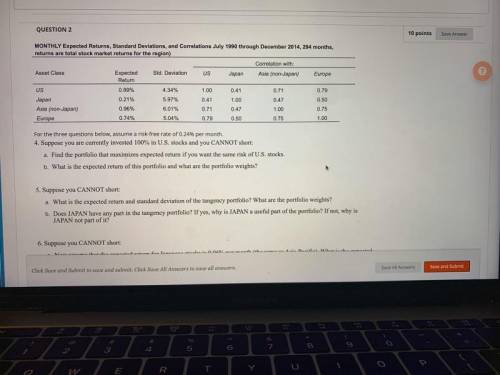

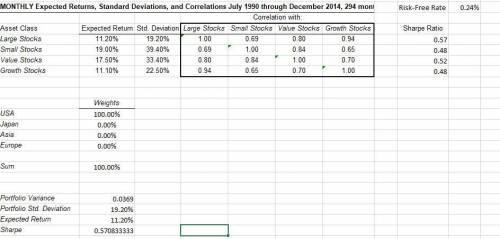

Suppose you are currently invested 100% in U. S. stocks and you CANNOT short: a. Find the portfolio that maximizes expected return if you want the same risk of U. S. stocks. b. What is the expected return of this portfolio and what are the portfolio weights

Answers: 1

Another question on Business

Business, 22.06.2019 07:00

Imagine you own an established startup with growing profits. you are looking for funding to greatly expand company operations. what method of financing would be best for you?

Answers: 2

Business, 22.06.2019 07:20

Suppose that real interest rates increase across europe. this development will u.s. net capital outflow at all u.s. real interest rates. this causes the loanable funds to because net capital outflow is a component of that curve.

Answers: 1

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

Business, 22.06.2019 19:40

Sue now has $125. how much would she have after 8 years if she leaves it invested at 8.5% with annual compounding? a. $205.83b. $216.67c. $228.07d. $240.08e. $252.08

Answers: 1

You know the right answer?

Suppose you are currently invested 100% in U. S. stocks and you CANNOT short: a. Find the portfolio...

Questions

Chemistry, 11.02.2020 03:03

Mathematics, 11.02.2020 03:03

English, 11.02.2020 03:03

History, 11.02.2020 03:03

Mathematics, 11.02.2020 03:03

Biology, 11.02.2020 03:03

History, 11.02.2020 03:03

Business, 11.02.2020 03:03

Geography, 11.02.2020 03:03

Social Studies, 11.02.2020 03:03