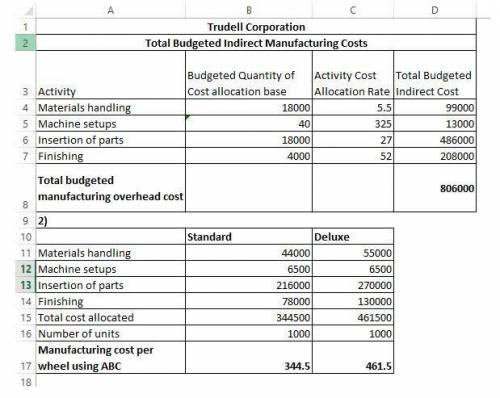

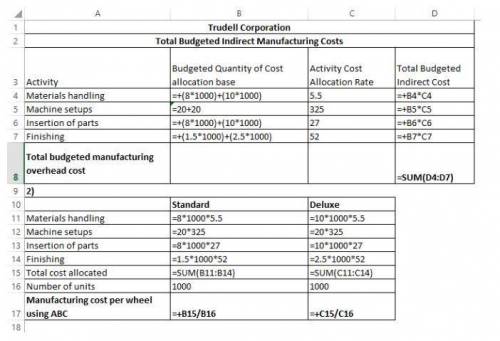

Activity Cost Activity Allocation Base Allocation Rate

Materials. handling. Number of...

Business, 20.02.2020 06:43 baleycardell9901

Activity Cost Activity Allocation Base Allocation Rate

Materials. handling. Number of parts $ 5.50 per part

Machine setup. Number of setups $ 325.00 per setup

Insertion of parts. Number of parts $ 27.00 per part

Finishing Finishing direct labor hours $ 52.00 per hour

Standard Deluxe

Parts per .wheel 8.0 Tallo J VI I . . . . . . . . . . . . . . . . . 10.0 20.0

Setups per 1,000 wheels 20.0

Finishing. direct. labor hours per wheel 1.5 2.5

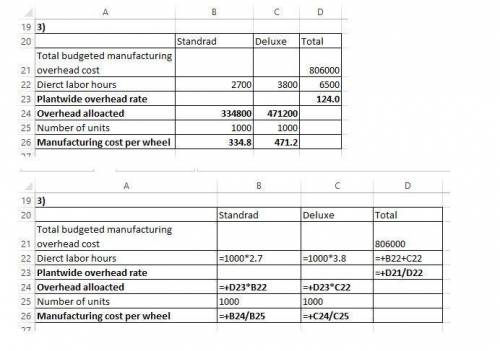

Total .direct labor. hours. per. wheel 2.7 - 3.8

The company's managers expect to produce 1,000 units of each model during the year.

1. Compute the total budgeted manufacturing overhead cost for the upcoming year.

2. Compute the manufacturing overhead cost per wheel of each model using ABC.

3. Compute the company's traditional plantwide overhead rate. Use this rate to determine th manufacturing overhead cost per wheel under the traditional system.

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Symantec corp., located in cupertino, california, is one of the world's largest producers of security and systems management software. the company's consolidated balance sheets for the 2009 and 2008 fiscal years included the following ($ in thousands): current assets: receivables, less allowances of $21,766 in 2009 and $24,089 in 2008 $ 838,010 $ 758,700 a disclosure note accompanying the financial statements reported the following ($ in thousands): year ended 2009 2008 (in thousands) trade accounts receivable, net: receivables $ 859,776 $ 782,789 less: allowance for doubtful accounts (8,938) (8,990) less: reserve for product returns (12,828) (15,099) trade accounts receivable, net: $ 838,010 $ 758,700 assume that the company reported bad debt expense in 2009 of $2,000 and had products returned for credit totaling $3,230 (sales price). net sales for 2009 were $6,174,800 (all numbers in thousands).required: what is the amount of accounts receivable due from customers at the end of 2009 and 2008? what amount of accounts receivable did symentec write off during 2009? what is the amount of symentec’s gross sales for the 2009 fiscal year? assuming that all sales are made on a credit basis, what is the amount of cash symentec collected from customers during the 2009 fiscal year?

Answers: 3

Business, 21.06.2019 21:00

Jameson manages a well-known cell phone company. this company has been voted as having the best cell-phone service. consumers appreciate the fact that they can call from almost anywhere in the world and the service still gets through. jameson knows that the company's product far surpasses that of the competition. one thing has been bothering him, though. in order to put so many resources into ensuring the best service, jameson has cut back on employees at the firm's customer call center. recently, consumers have begun complaining about long wait times when they call in with a problem or concern. although its cell phone service is still considered one of the best, customer satisfaction with the firm's customer service has plummeted. jameson does not understand why consumers are getting so upset. he believes the exceptional cell phone service more than makes up for long waiting periods and other issues with its customer service. "after all," he says, "they can't have it all. if i invest more in customer service, that means less investment on ensuring the quality of our product offering."refer to scenario. jameson has asked you, a marketing consultant, to give him advice. he cannot understand how a cell-phone company with the best product offering in the cell-phone service industry could get such low satisfaction ratings simply because the customer service is not up to par. you suggest that jameson has a narrowly defined view of the company's product offering. you tell jameson that successful marketers should define their products as what they

Answers: 2

Business, 22.06.2019 03:00

Which of the following is not a consideration when determining your asset allocation

Answers: 3

Business, 22.06.2019 06:50

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

You know the right answer?

Questions

Mathematics, 23.03.2021 19:20

World Languages, 23.03.2021 19:20

Mathematics, 23.03.2021 19:20

Health, 23.03.2021 19:20

Physics, 23.03.2021 19:20

Social Studies, 23.03.2021 19:20

Chemistry, 23.03.2021 19:20

Chemistry, 23.03.2021 19:20

English, 23.03.2021 19:20

History, 23.03.2021 19:20

World Languages, 23.03.2021 19:20

Mathematics, 23.03.2021 19:20

History, 23.03.2021 19:20