Business, 19.02.2020 05:52 jaydenrenee111902

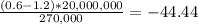

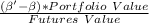

A company has a $20 million portfolio with a beta of 1.2. It would like to use futures contracts on a stock index to hedge its risk. The index futures is currently standing at 1080, and each contract is for delivery of $250 times the index. What is the hedge that minimizes risk? What should the company do if it wants to reduce the beta of the portfolio to 0.6?

Answers: 2

Another question on Business

Business, 22.06.2019 10:00

Scenario: you have advised the owner of bond's gym that the best thing to do would be to raise the price of a monthly membership. the owner wants to know what may happen once this price increase goes into effect. what will most likely occur after the price of a monthly membership increases? check all that apply. current members will pay more per month. the quantity demanded for memberships will decrease. the number of available memberships will increase. the owner will make more money. bond's gym will receive more membership applications.

Answers: 1

Business, 22.06.2019 14:30

Your own record of all your transactions. a. check register b. account statement

Answers: 1

Business, 22.06.2019 19:00

20. to add body to a hearty broth, you may use a. onions. b. pasta. c. cheese. d. water.

Answers: 2

Business, 22.06.2019 20:00

Ajax corp's sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. what was the firm's times-interest-earned (tie) ratio? a. 4.72b. 4.97c. 5.23d. 5.51e. 5.80

Answers: 1

You know the right answer?

A company has a $20 million portfolio with a beta of 1.2. It would like to use futures contracts on...

Questions

is the new value=0.6

is the new value=0.6 =1.2

=1.2