Business, 19.02.2020 00:03 tiarafaimealelei

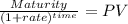

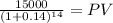

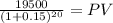

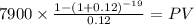

How much would you have to invest today to receive the following? Use Appendix B and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a.$15,000 in 10 years at 14 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)b.$19,500 in 20 years at 15 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places. c.$7,900 each year for 19 years at 12 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)d.$54,000 each year for 50 years at 10 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Answers: 2

Another question on Business

Business, 21.06.2019 18:00

You want to make an investment in a continuously compounding account over a period of two years. what interest rate is required for your investment to double in that time period? round the logarithm value and the answer to the nearest tenth.

Answers: 3

Business, 22.06.2019 02:00

Ida sidha karya company is a family-owned company located on the island of bali in indonesia. the company produces a handcrafted balinese musical instrument called a gamelan that is similar to a xylophone. the gamelans are sold for $860. selected data for the company’s operations last year follow: units in beginning inventory 0 units produced 320 units sold 285 units in ending inventory 35 variable costs per unit: direct materials $ 135 direct labor $ 355 variable manufacturing overhead $ 30 variable selling and administrative $ 15 fixed costs: fixed manufacturing overhead $ 64,000 fixed selling and administrative $ 27,000 the absorption costing income statement prepared by the company’s accountant for last year appears below: sales $ 245,100 cost of goods sold 205,200 gross margin 39,900 selling and administrative expense 31,275 net operating income $ 8,625 required: 1. under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. prepare an income statement for last year using variable costing. what is the amount of the difference in net operating income between the two costing methods?

Answers: 1

Business, 22.06.2019 12:30

howard, fine, & howard is an advertising agency. the firm uses an activity-based costing system to allocate overhead costs to its services. information about the firm's activity cost pool rates follows: stooge company was a client of howard, fine, & howard. recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the stooge company account. using the activity-based costing system, how much overhead cost would be allocated to the stooge company account?

Answers: 1

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

You know the right answer?

How much would you have to invest today to receive the following? Use Appendix B and Appendix D for...

Questions

Biology, 01.02.2021 22:30

Mathematics, 01.02.2021 22:30

Mathematics, 01.02.2021 22:30

Mathematics, 01.02.2021 22:30

Mathematics, 01.02.2021 22:30

Chemistry, 01.02.2021 22:30

English, 01.02.2021 22:30

Social Studies, 01.02.2021 22:30

Health, 01.02.2021 22:30