Business, 18.02.2020 05:26 alyxkellar06

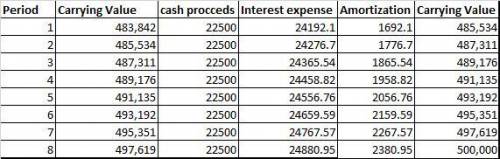

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $500,000 on January 1, 2021. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity the market yield was 10%. Interest is paid semiannually on June 30 and December 31.

Required:

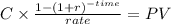

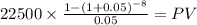

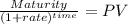

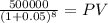

a. Determine the price of the bonds at January 1, 2021.

b. Prepare the journal entry to record their issuance by National on January 1, 2021.

c. Prepare an amortization schedule that determines interest at the effective rate each period.

d. Prepare the journal entry to record interest on June 30, 2021.

e. Prepare the appropriate journal entries at maturity on December 31, 2024.

Answers: 2

Another question on Business

Business, 21.06.2019 14:00

Take it all away has a cost of equity of 10.63 percent, a pretax cost of debt of 5.33 percent, and a tax rate of 35 percent. the company's capital structure consists of 71 percent debt on a book value basis, but debt is 31 percent of the company's value on a market value basis. what is the company's wacc?

Answers: 2

Business, 22.06.2019 13:30

On january 2, well co. purchased 10% of rea, inc.’s outstanding common shares for $400,000, which equaled the carrying amount and the fair value of the interest purchased in rea’s net assets. well did not elect the fair value option. because well is the largest single shareholder in rea, and well’s officers are a majority on rea’s board of directors, well exercises significant influence over rea. rea reported net income of $500,000 for the year and paid dividends of $150,000. in its december 31 balance sheet, what amount should well report as investment in rea?

Answers: 3

Business, 22.06.2019 18:10

Ashop owner uses a reorder point approach to restocking a certain raw material. lead time is six days. usage of the material during lead time is normally distributed with a mean of 42 pounds and a standard deviation of four pounds. when should the raw material be reordered if the acceptable risk of a stockout is 3 percent?

Answers: 1

Business, 22.06.2019 21:30

Russell's study compared gpa of those students who volunteered for academic study skills training and those who did not elect to take the training. he found that those who had the training also had higher gpa. with which validity threat should russell be most concerned?

Answers: 2

You know the right answer?

National Orthopedics Co. issued 9% bonds, dated January 1, with a face amount of $500,000 on January...

Questions

Mathematics, 27.01.2021 03:20

Mathematics, 27.01.2021 03:20

Mathematics, 27.01.2021 03:20

Chemistry, 27.01.2021 03:20

Social Studies, 27.01.2021 03:20

Mathematics, 27.01.2021 03:20

Mathematics, 27.01.2021 03:20

Mathematics, 27.01.2021 03:20

History, 27.01.2021 03:20