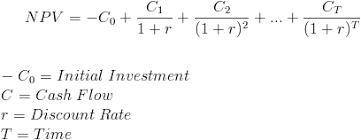

4 . Net present value method Ewing Corporation is evaluating a proposed capital budgeting project that will require an initial investment of $136,000. The project is expected to generate the following net cash flows: Year Cash Flow 1 $40,000 2 $50,900 3 $46,200 4 $43,900 Assume the desired rate of return on a project of this type is 9%. The net present value of this project is Suppose Ewing Corporation has enough capital to fund the project, and the project is not competing for funding with other projects. Should Ewing Corporation accept or reject this project? Reject the project Accept the project

Answers: 2

Another question on Business

Business, 22.06.2019 06:00

Select the correct answer a research organization conducts certain chemical tests on samples. they have data available on the standard results. some of the samples give results outside the boundary of the standard results. which data mining method follows a similar approach? o a. data cleansing ob. network intrusion o c. fraud detection od. customer classification o e. deviation detection

Answers: 1

Business, 22.06.2019 12:30

True or false entrepreneurs try to meet the needs of the marketplace by supplying a service or product

Answers: 1

Business, 22.06.2019 13:30

If the economy were in the contracting phase of the business cycle, how might that affect your ability to find work?

Answers: 2

Business, 22.06.2019 20:00

The master manufacturing company has just announced a tender offer for its own common stock. master is offering to buy up to 100% of the company's stock at $20 per share contingent on at least 64% of the outstanding shares being tendered. after the announcement of the offer, the stock closed on the nyse up 2.50 at $18.75. a customer has 100 shares of master stock in his cash account. the customer tells you that he wishes to "cash out" his position. you should recommend that the customer:

Answers: 2

You know the right answer?

4 . Net present value method Ewing Corporation is evaluating a proposed capital budgeting project th...

Questions

History, 04.04.2020 04:31

Mathematics, 04.04.2020 04:31

Health, 04.04.2020 04:31

Mathematics, 04.04.2020 04:31

SAT, 04.04.2020 04:31

Mathematics, 04.04.2020 04:31

Social Studies, 04.04.2020 04:31

History, 04.04.2020 04:31

Chemistry, 04.04.2020 04:31

Mathematics, 04.04.2020 04:31

Computers and Technology, 04.04.2020 04:31