Business, 14.02.2020 20:52 cheycheybabygirl01

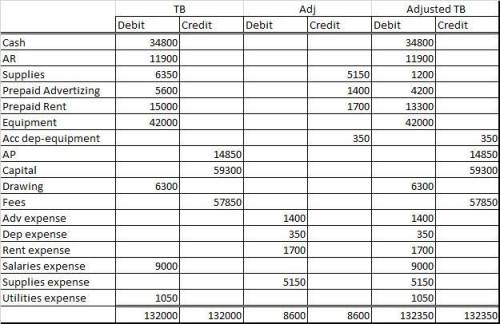

Supplies were purchased on January 1, 2019; inventory of supplies on January 31, 2019, is $1,200. The prepaid advertising contract was signed on January 1, 2019, and covers a four-month period. Rent of $1,700 expired during the month. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value.

a. Complete the worksheet for the month.

b. Prepare an income statement, statement of owner’s equity, and balance sheet. No additional investments were made by the owner during the month.

c. Journalize and post the adjusting entries.

d. If the adjusting entries had not been made for the month, would the net income be overstated or understated?

Answers: 2

Another question on Business

Business, 22.06.2019 05:20

Social computing forces companies to deal with customers as opposed to

Answers: 2

Business, 22.06.2019 17:30

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 22.06.2019 20:00

Question 6 of 102 pointswhich situation shows a constant rate of change? oa. the number of tickets sold compared with the number of minutesbefore a football gameob. the height of a bird over timeoc. the cost of a bunch of grapes compared with its weightod. the outside temperature compared with the time of day

Answers: 1

You know the right answer?

Supplies were purchased on January 1, 2019; inventory of supplies on January 31, 2019, is $1,200. Th...

Questions

Mathematics, 15.05.2021 01:00

Mathematics, 15.05.2021 01:00

Social Studies, 15.05.2021 01:00

Biology, 15.05.2021 01:00

Arts, 15.05.2021 01:00

Mathematics, 15.05.2021 01:00

Mathematics, 15.05.2021 01:00

Mathematics, 15.05.2021 01:00

Arts, 15.05.2021 01:00

Mathematics, 15.05.2021 01:00

Mathematics, 15.05.2021 01:00

Mathematics, 15.05.2021 01:00