Business, 14.02.2020 04:45 iwannasleep

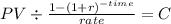

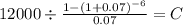

An extremely important application of interest involves amortized loans. Some common types of amortized loans are automobile loans, home mortgage loans, student loans, and many business loans. Each loan payment consists of interest and repayment of principal. This breakdown is often developed in an amortization schedule. Interest is in the first period and over the life of the loan, while the principal part repayment is in the first period and it thereafter. Quantitative Problem: You need $12,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 6 years, with the first payment to be made one year from today. He requires a 7% annual return. What will be your annual loan payments? Round your answer to the nearest cent. Do not round intermediate calculations. $ How much of your first payment will be applied to interest and to principal repayment? Round your answer to the nearest cent. Do not round intermediate calculations. Interest: $ Principal repayment: $

Answers: 3

Another question on Business

Business, 22.06.2019 05:30

Find a company that has followed a strong strategic direction- state that generic strategy and the back-up points to support your position.

Answers: 1

Business, 22.06.2019 13:30

Presented below is information for annie company for the month of march 2018. cost of goods sold $245,000 rent expense $ 36,000 freight-out 7,000 sales discounts 8,000 insurance expense 5,000 sales returns and allowances 11,000 salaries and wages expense 63,000 sales revenue 410,000 instructions prepare the income statement.

Answers: 2

Business, 22.06.2019 18:00

1. what is the amount of interest earned after two years on a $100 deposit paying 4 percent simple interest annually? $8.00 $4.08 $8.16 $4.00 2. what is the amount of compound interest earned after three years on a $100 deposit paying 8 percent interest annually? $24.00 $8.00 $16.64 $25.97 3. a business just took out a loan for $100,000 at 10% interest. if the business pays the loan off in three months, how much did the business pay in interest? $2,500.00 $10.00 $250.00 $10,000.00 4. what is the annual percentage yield (apy) for a deposit paying 5 percent interest with monthly compounding? 5.00% 5.12% 79.59% 0.42%

Answers: 1

Business, 22.06.2019 20:30

The research of robert siegler and eric jenkins on the development of the counting-on strategy is an example of design.

Answers: 3

You know the right answer?

An extremely important application of interest involves amortized loans. Some common types of amorti...

Questions

History, 26.10.2021 09:20

Social Studies, 26.10.2021 09:20

Computers and Technology, 26.10.2021 09:20

Social Studies, 26.10.2021 09:20

Mathematics, 26.10.2021 09:20

Mathematics, 26.10.2021 09:20

Social Studies, 26.10.2021 09:20

Mathematics, 26.10.2021 09:20

Mathematics, 26.10.2021 09:20