Assume that you are the chief financial officer at Porter Memorial Hospital. The CEO has asked to to analyze two proposed capital investments Project X and Project Y. Each project requires a net investment outlay of $10,000, and the cost of capital for each project is 12%. The projects’ expected net cash flows are;

Year Project X Project Y

0 ($10,000) ($10,000)

1 6,500 3,000

2 3,000 3,000

3 3,000 3,000

4 1,000 3,000

Question; Calculate each project’s payback period, net present value, and internal rate of return.

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

The owners of backstreets italian restaurant are considering starting a delivery service forpizza and their other italian dishes in the small college town where they are located. theycan purchase a used delivery van and have it painted with their name and logo for $21,500.they can hire part-time drivers who will work in the evenings from 5 p.m. to 10 p.m. for$8 per hour. the drivers are mostly college students who study at the restaurant when theyare not making deliveries. during the day, there are so few deliveries that the regular employeescan handle them. the owners estimate that the van will last 5 years (365 days per year)before it has to be replaced and that each delivery will cost about $1.35 in gas and othermaintenance costs (including tires, oil, scheduled service, they also estimate that onaverage each delivery order will cost $15 for direct labor and ingredients to prepare andpackage, and will generate $34 in revenue.a. how many delivery orders must backstreets make each month in order for the service to break even? b. the owners believe that if they have approximately the break-even number of deliveries during the week, they will at least double that number on fridays, saturdays, and sundays. if that’s the case, how much profit will they make, at a minimum, from their delivery service each month (4 weeks per month)?

Answers: 2

Business, 22.06.2019 20:00

Assume the perpetual inventory method is used. 1) the company purchased $12,500 of merchandise on account under terms 2/10, n/30. 2) the company returned $1,200 of merchandise to the supplier before payment was made. 3) the liability was paid within the discount period. 4) all of the merchandise purchased was sold for $18,800 cash. what effect will the return of merchandise to the supplier have on the accounting equation?

Answers: 2

Business, 23.06.2019 02:40

Sean lives in dallas and runs a business that sells boats. in an average year, he receives $722,000 from selling boats. of this sales revenue, he must pay the manufacturer a wholesale cost of $422,000; he also pays wages and utility bills totaling $268,000. he owns his showroom; if he chooses to rent it out, he will receive $2,000 in rent per year. assume that the value of this showroom does not depreciate over the year. also, if sean does not operate this boat business, he can work as a paralegal, receive an annual salary of $21,000 with no additional monetary costs, and rent out his showroom at the $2,000 per year rate. no other costs are incurred in running this boat business.identify each of sean's costs in the following table as either an implicit cost or an explicit cost of selling boats.implicit costexplicit costthe wages and utility bills that sean pays the rental income sean could receive if he chose to rent out his showroom the salary sean could earn if he worked as a paralegal the wholesale cost for the boats that sean pays the

Answers: 2

Business, 23.06.2019 04:50

Suppose an investor starts with a portfolio consisting of one randomly selected stock. as more and more randomly selected stocks are added to the portfolio, what happens to the portfolio's risk

Answers: 1

You know the right answer?

Assume that you are the chief financial officer at Porter Memorial Hospital. The CEO has asked to to...

Questions

Mathematics, 08.04.2020 01:07

Mathematics, 08.04.2020 01:07

Computers and Technology, 08.04.2020 01:07

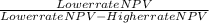

( higher rate - lower rate)

( higher rate - lower rate) (0.12-0.10) = 17.38%

(0.12-0.10) = 17.38% (0.12-0.10) = 7.54%

(0.12-0.10) = 7.54%