Business, 12.02.2020 05:46 Gloryreak3728

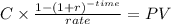

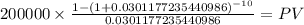

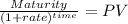

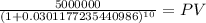

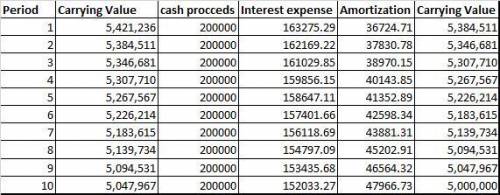

Clark Company sells 8% bonds having a maturity value of $5,000,000 for $5,421,236. The bonds are dated January 1, 2017, and mature January 1, 2022. Interest is payable annually on January 1. Set up a schedule of interest expense and premium amortization under the effective-interest method. (Hint: The effective interest rate must be computed.)

Answers: 1

Another question on Business

Business, 21.06.2019 20:50

Last year, western corporation had sales of $5 million, cost of goods sold of $3 million, operating expenses of $175,000 and depreciation of $125,000. the firm received $40,000 in dividend income and paid $200,000 in interest on loans. also, western sold stock during the year, receiving a $40,000 gain on stock owned 6 years, but losing $60,000 on stock owned 4 years. what is the firm's tax liability?

Answers: 2

Business, 22.06.2019 01:00

Cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely: cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely:

Answers: 3

Business, 22.06.2019 02:10

Materials purchases (on credit). direct materials used in production. direct labor paid and assigned to work in process inventory. indirect labor paid and assigned to factory overhead. overhead costs applied to work in process inventory. actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) transfer of jobs 306 and 307 to finished goods inventory. cost of goods sold for job 306. revenue from the sale of job 306. assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions.

Answers: 1

Business, 22.06.2019 16:40

Job 456 was recently completed. the following data have been recorded on its job cost sheet: direct materials $ 2,418 direct labor-hours 74 labor-hours direct labor wage rate $ 13 per labor-hour machine-hours 137 machine-hours the corporation applies manufacturing overhead on the basis of machine-hours. the predetermined overhead rate is $14 per machine-hour. the total cost that would be recorded on the job cost sheet for job 456 would be: multiple choice $3,380 $5,298 $6,138 $2,622

Answers: 1

You know the right answer?

Clark Company sells 8% bonds having a maturity value of $5,000,000 for $5,421,236. The bonds are dat...

Questions

Chemistry, 18.02.2022 03:30

Mathematics, 18.02.2022 03:30

Biology, 18.02.2022 03:30

Mathematics, 18.02.2022 03:30

English, 18.02.2022 03:30

Physics, 18.02.2022 03:30

Mathematics, 18.02.2022 03:30

Mathematics, 18.02.2022 03:30

Social Studies, 18.02.2022 03:30

Arts, 18.02.2022 03:30

English, 18.02.2022 03:30