Business, 04.02.2020 05:44 jackfooman3100

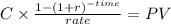

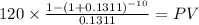

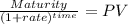

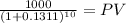

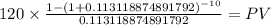

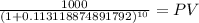

A10-year maturity bond with par value of $1,000 makes annual coupon payments at a coupon rate of 12%. find the bond equivalent and effective annual yield to maturity of the bond for the following bond prices. (round your answers to 2 decimal places.)a. find the bond equivalent and effective annual yield to maturity of the bond if the bond price is $940. bond equivalent yield to maturity %

effective annual yield to maturity % b. find the bond equivalent and effective annual yield to maturity of the bond if the bond price is $1,000. bond equivalent yield to maturity %

effective annual yield to maturity % c. find the bond equivalent and effective annual yield to maturity of the bond if the bond price is $1,040. bond equivalent yield to maturity %

effective annual yield to maturity %

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

An employer who is considering hiring eva has asked donna, eva’s former supervisor, for a report on eva. in truth, eva’s work for donna has been only average. however, eva is donna’s friend, and donna knows that eva probably will not get the job if she says anything negative about eva, and donna knows that eva desperately needs the job. further, donna knows that if the situation were reversed, she would not want eva to mention her deficiencies. nevertheless, it has been donna’s policy to reveal the deficiencies of employees when she has been asked for references by employers, and she knows that some of eva’s faults may be bothersome to this particular employer. finally, this employer has leveled with donna in the past when donna has asked for a report on people who have worked for him. should donna reveal deficiencies in eva’s past performance? (remember to use one of the three moral theories acceptable for this test to solve this dilemma. any discussion of any personal opinion, religious perspective, or theory other than the moral theories acceptable for this test will result in a score of "0" for this question.)

Answers: 1

Business, 22.06.2019 21:40

The farmer's market just paid an annual dividend of $5 on its stock. the growth rate in dividends is expected to be a constant 5 percent per year indefinitely. investors require a 13 percent return on the stock for the first 3 years, a 9 percent return for the next 3 years, a 7 percent return thereafter. what is the current price per share? select one: a. $212.40 b. $220.54 c. $223.09 d. $226.84 e. $227.50 previous pagenext page

Answers: 2

Business, 23.06.2019 11:00

What are the factors that affects on the process of planning

Answers: 3

Business, 23.06.2019 14:20

Inflation is when money is paid for the same amount of goods and services than in a previous time period. the same amount less more none of the above

Answers: 1

You know the right answer?

A10-year maturity bond with par value of $1,000 makes annual coupon payments at a coupon rate of 12%...

Questions

Mathematics, 24.03.2021 02:30

Mathematics, 24.03.2021 02:30

Mathematics, 24.03.2021 02:30

Health, 24.03.2021 02:30

Business, 24.03.2021 02:30

Biology, 24.03.2021 02:30

Business, 24.03.2021 02:30

Mathematics, 24.03.2021 02:30

Mathematics, 24.03.2021 02:30

History, 24.03.2021 02:30

Mathematics, 24.03.2021 02:40

History, 24.03.2021 02:40