Business, 04.02.2020 05:40 isabellemaine

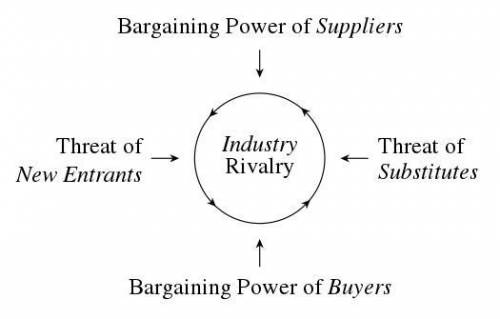

Recently, european union (eu) governments approved a five-year eu trade protection against grain-oriented electrical steel (goes) from russia, japan, china, south korea, and the united states. the protection would consist of minimum import prices on shipments of goes from any of the five listed countries. this measure was enacted as a punishment for exporters in these countries for allegedly dumping their product (i. e., selling below cost) on the european market. the european steel association lauded the plan, noting it would protect an important subdivision of the steel industry. however, transformer manufacturers, who use goes as an input to their production, have protested the minimum prices. they argue minimum prices will result in prices for goes that are too high and lead to some of these manufacturers to downsize or move production facilities outside the eu. describe the various rivalries depicted in this scenario, and then use the five forces framework to analyze the industry.

Answers: 3

Another question on Business

Business, 21.06.2019 13:30

Yard tools manufactures lawnmowers, weed-trimmers, and chainsaws. its sales mix and unit contribution margin are as follows. sales mix unit contribution margin lawnmowers 20 % $30 weed-trimmers 50 % $20 chainsaws 30 % $40 yard tools has fixed costs of $4,200,000. compute the number of units of each product that yard tools must sell in order to break even under this product mix.

Answers: 3

Business, 22.06.2019 20:30

The former chairman of the federal reserve, alan greenspan, used the term "irrational exuberance" in 1996 to describe the high levels of optimism among stock market investors at the time. stock market indexes such as the s& p composite price index were at an all-time high. some commentators believed that the fed should intervene to slow the expansion of the economy. why would central banks want to clamp down when the economy is growing? a. to block the formation of unsustainable speculative asset bubbles. b. to curtail excessive profits in the banking system. c. to prevent inflationary forces from gathering momentum. d. all of the above. e. a and c only.

Answers: 3

Business, 23.06.2019 00:30

Considered to be a "super tool" or tool that has high use and high potential for improving project success?

Answers: 3

Business, 23.06.2019 03:00

In each of the cases below, assume division x has a product that can be sold either to outside customers or to division y of the same company for use in its production process. the managers of the divisions are evaluated based on their divisional profits. case a b division x: capacity in units 200,000 200,000 number of units being sold to outside customers 200,000 160,000 selling price per unit to outside customers $ 90 $ 75 variable costs per unit $ 70 $ 60 fixed costs per unit (based on capacity) $ 13 $ 8 division y: number of units needed for production 40,000 40,000 purchase price per unit now being paid to an outside supplier $ 86 $ 74 required: 1. refer to the data in case a above. assume in this case that $3 per unit in variable selling costs can be avoided on intracompany sales. a. what is the lowest acceptable transfer price from the perspective of the selling division? b. what is the highest acceptable transfer price from the perspective of the buying division? c. what is the range of acceptable transfer prices (if any) between the two divisions? if the managers are free to negotiate and make decisions on their own, will a transfer probably take place?

Answers: 3

You know the right answer?

Recently, european union (eu) governments approved a five-year eu trade protection against grain-ori...

Questions

Chemistry, 02.11.2020 23:50

Mathematics, 02.11.2020 23:50

Mathematics, 02.11.2020 23:50

French, 02.11.2020 23:50

Spanish, 02.11.2020 23:50

Mathematics, 02.11.2020 23:50

Biology, 02.11.2020 23:50

Mathematics, 02.11.2020 23:50

English, 02.11.2020 23:50

Mathematics, 02.11.2020 23:50

Spanish, 02.11.2020 23:50