Business, 28.01.2020 22:41 coralstoner6793

Snapshot company, a commercial photography studio, has just completed its first full year of operations on december 31, 2015. general ledger account balances before year-end adjustments follow; no adjusting entries have been made to the accounts at any time during the year. assume that all balances are normal.

cash $2150

prepaid rent $1,910

supplies 3,800

unearned photography fees 26,00

common stock 24,000

wages expense 11,000

equipment 22,800

utilities expense 3,420

an analysis of the firm's records discloses the following.

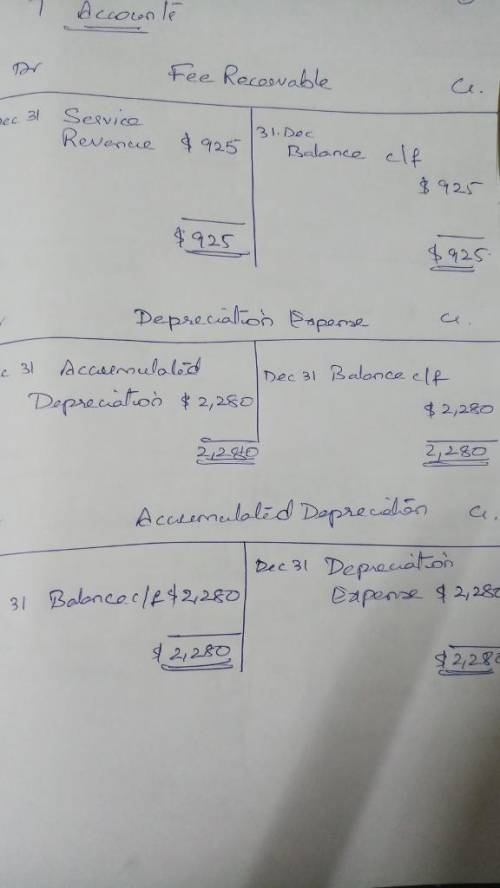

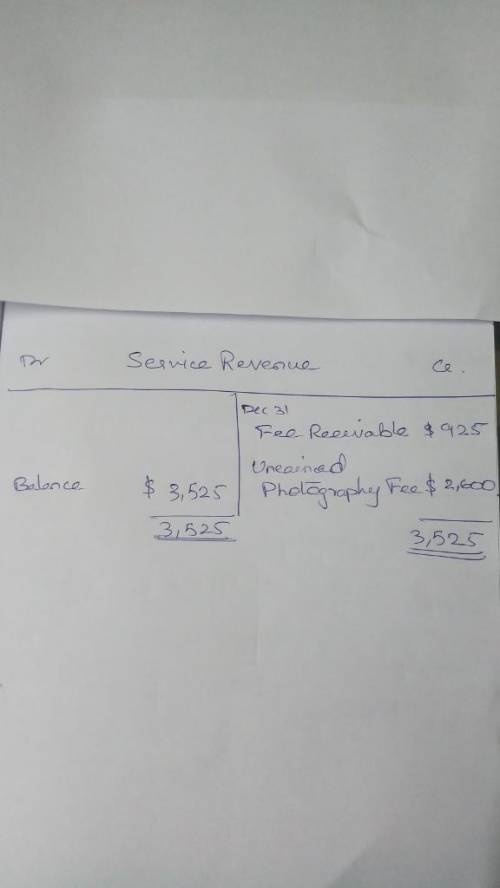

1. photography services of $925 have been rendered, but customers have not yet paid or beern billed. the firm uses the account fees receivable to reflect amounts due but not yet billed.

2. equipment, purchased january 1,2015, has an estimated life of 10 years.

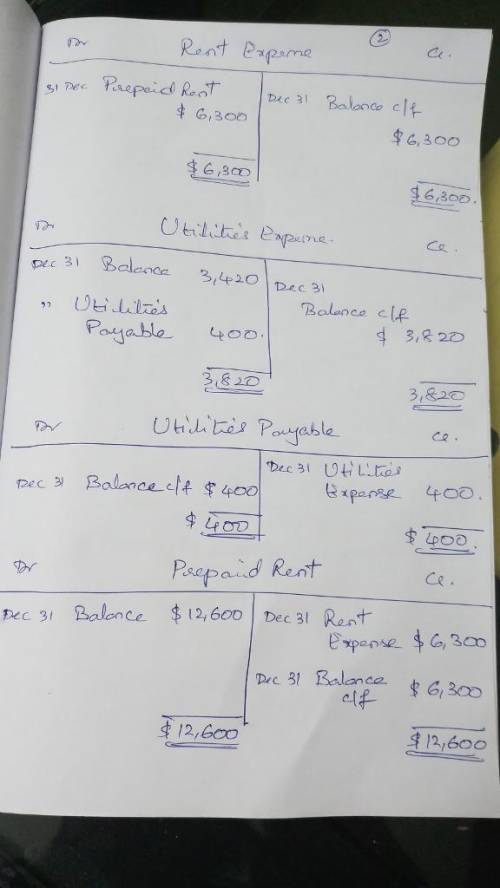

3. utilities expense for december is estimated to be $400, but the bill will not arrive or be paid until january of next year.

4. the balance in prepaid rent represents the amount paid on january 1,2015, for a 2-year lease on the studio.

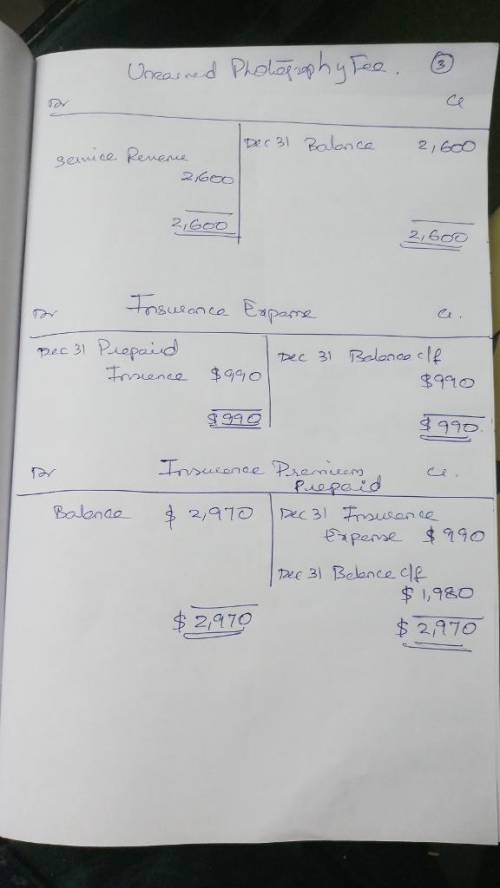

5. in november, customers paid $2,600 cash in advance for photos to be taken for the holiday season. when received, these fees were credited to unearned photography fees. by december 31, all of these fees are earned.

6. a 3-year insurance premium paid on january 1,2015, was debited to prepaid insurance.

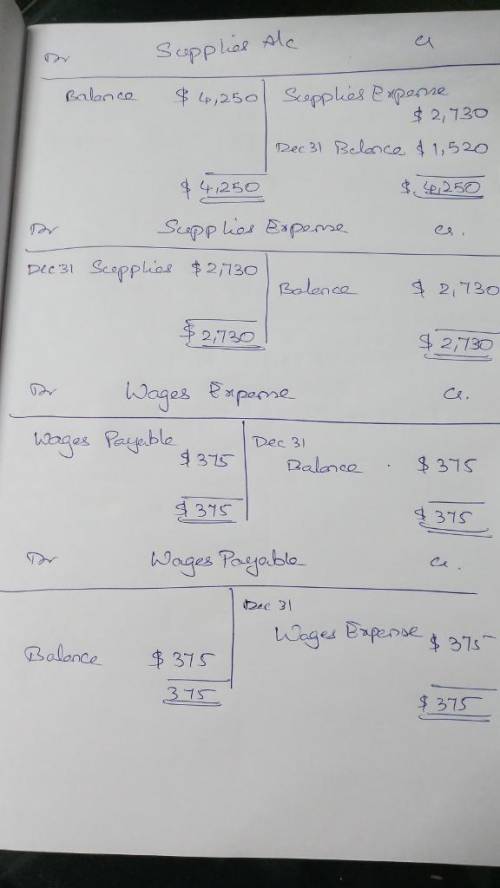

7. supplies available at december 31 are $1,520.

8. at december 31, wages expense of $375 has been incurred but not paid or recorded.

required:

a. prove that debits equal credits for snapshot's unadjusted account balances by preparing its unadjusted trial balance at december 31, 2015.

b. prepare its adjusting entries using the financial statement effects template.

c. prepare its adjusting entries in journal entry form.

d. set up t-accounts, enter the balances above, and post the adjusting entries to them.

Answers: 3

Another question on Business

Business, 22.06.2019 06:50

On january 1, vermont corporation had 40,000 shares of $10 par value common stock issued and outstanding. all 40,000 shares has been issued in a prior period at $20.00 per share. on february 1, vermont purchased 3,750 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on march 1. the journal entry to record the purchase of the treasury shares on february 1 would include a credit to treasury stock for $90,000 debit to treasury stock for $90,000 credit to a gain account for $112,500 debit to a loss account for $112,500

Answers: 3

Business, 22.06.2019 17:00

Dan wants to start a supermarket in his hometown, and wants to get into the business only after finding out about the market and how successful his business might be. the best way for dan to gain knowledge is to:

Answers: 2

Business, 22.06.2019 21:40

The following items could appear on a bank reconciliation: a. outstanding checks, $670. b. deposits in transit, $1,500. c. nsf check from customer, no. 548, for $175. d. bank collection of note receivable of $800, and interest of $80. e. interest earned on bank balance, $20. f. service charge, $10. g. the business credited cash for $200. the correct amount was $2,000. h. the bank incorrectly decreased the business's by $350 for a check written by another business. classify each item as (1) an addition to the book balance, (2) a subtraction from the book balance, (3) an addition to the bank balance, or (4) a subtraction from the bank balance.

Answers: 1

Business, 23.06.2019 00:20

Barney corporation recognized a $100 million preferred stock balance on 12/31/2019. on january 1, 2020, barney issued $10 million in preferred dividends. on the same date, barney raised an additional $20 million via a new issuance of preferred stock. on december 31, 2020, the market value of the original amount of preferred shares rose $5 million. under us gaap, the 12/31/2020 year ending preferred stock balance is:

Answers: 3

You know the right answer?

Snapshot company, a commercial photography studio, has just completed its first full year of operati...

Questions

Chemistry, 18.04.2020 11:10

History, 18.04.2020 11:11

History, 18.04.2020 11:26

Mathematics, 18.04.2020 11:26

History, 18.04.2020 11:27

Biology, 18.04.2020 11:27

History, 18.04.2020 11:27

Mathematics, 18.04.2020 11:27

Mathematics, 18.04.2020 11:27

Mathematics, 18.04.2020 11:27

Mathematics, 18.04.2020 11:27

Physics, 18.04.2020 11:27