Business, 25.01.2020 02:31 zaynmaliky4748

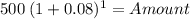

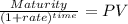

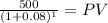

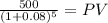

Find the following values for the lump sum assuming annual compounding: the future value of $500 invested at 8 percent for one year. future value=$500 * (1+0.08) ^1future value=$540the future value of $500 invested at 8 percent for five years. future value=$500 * (1+0.08) ^5future value=$734.66the present value of $500 to be received in one year when the opportunity cost rate is 8 percent. present value=$500/(1+0.08) ^1present value =$462.96the present value of $500 to be received in five years when the opportunity cost rate is 8 percent. present value=$500/(1+0.08) ^5present value =$340.29

Answers: 1

Another question on Business

Business, 22.06.2019 04:00

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 23:30

Which career pathways require workers to train at special academies? a.emts and emergency dispatchers b.crossing guards and lifeguards c.police officers and firefighters d.lawyers and judges

Answers: 3

Business, 23.06.2019 01:00

Need with an adjusting journal entrycmc records depreciation and amortization expense annually. they do not use an accumulated amortization account. (i.e. amortization expense is recorded with a debit to amort. exp and a credit to the patent.) annual depreciation rates are 7% for buildings/equipment/furniture, no salvage. (round to the nearest whole dollar.) annual amortization rates are 10% of original cost, straight-line method, no salvage. cmc owns two patents: patent #fj101 and patent #cq510. patent #cq510 was acquired on october 1, 2016. patent #fj101 was acquired on april 1, 2018 for $119,000. the last time depreciation & amortization were recorded was december 31, 2017.before adjustment: land: 348791equpment and furniture: 332989building: 876418patents 217000

Answers: 3

Business, 23.06.2019 01:00

Weekly sales at nancy's restaurant total $ 84,000. labor required is 420 hours at a cost of $21,000. raw materials used amount to $40,000. what is the partial measure of productivity for labor hours?

Answers: 1

You know the right answer?

Find the following values for the lump sum assuming annual compounding: the future value of $500 inv...

Questions

Biology, 15.05.2021 03:20

Mathematics, 15.05.2021 03:20

Mathematics, 15.05.2021 03:20

Mathematics, 15.05.2021 03:20

Biology, 15.05.2021 03:20

Mathematics, 15.05.2021 03:20