Business, 22.01.2020 23:31 elijahjacksonrp6z2o7

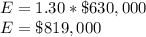

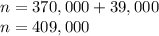

Allen lumber company had earnings after taxes of $630,000 in the year 2009 with 370,000 shares outstanding on december 31, 2009. on january 1, 2010, the firm issued 39,000 new shares. because of the proceeds from these new shares and other operating improvements, 2010 earnings after taxes were 30 percent higher than in 2009. earnings per share for the year 2010 were (r

Answers: 2

Another question on Business

Business, 22.06.2019 10:30

6carla would like to buy a dress, a dresser for her bedroom, and a home theater system. she has one month's worth of living expenses in her emergency fund. carla decides to save for the home theater system. did carla make the right decision? why or why not? a. yes; her emergency fund is full and the other items will probably be less expensive. b. yes; she could save more for her emergency fund, but the home theater will be harder to save for. c. no; she should save more for her emergency fund because she has saved less than the recommended amount. d. no; she should have bought the dress and dresser first because she could afford them right away. reset next

Answers: 2

Business, 23.06.2019 00:40

An upper-middle-class manager tends to have hostile relationship with the working-class employees in the firm because of his tendency to perceive himself as superior to them based on his class background. in this example, the manager exhibits: question 14 options: 1) class consciousness. 2) cultural awareness. 3) social mobility. 4) group orientation.

Answers: 3

Business, 23.06.2019 02:00

Acompany sells garden hoses and uses the perpetual inventory system to account for its merchandise. the beginning balance of the inventory and its transactions during september were as follows:

Answers: 2

Business, 23.06.2019 02:50

Dakota company experienced the following events during 2016. 1. acquired $30,000 cash from the issue of common stock. 2. paid $12,000 cash to purchase land. 3. borrowed $10,000 cash. 4. provided services for $20,000 cash. 5. paid $1,000 cash for utilities expense. 6. paid $15,000 cash for other operating expenses. 7. paid a $2,000 cash dividend to the stockholders. 8. determined that the market value of the land purchased in event 2 is now $12,700

Answers: 1

You know the right answer?

Allen lumber company had earnings after taxes of $630,000 in the year 2009 with 370,000 shares outst...

Questions

Geography, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

English, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

History, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

Computers and Technology, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

English, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

English, 19.12.2021 06:10

Biology, 19.12.2021 06:10