Business, 21.01.2020 01:31 fannyrivera321

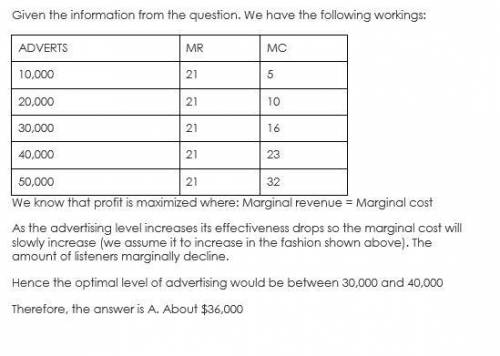

Georgetown public media is trying to determine the optimum amount for its advertising budget. calculating the marginal revenue of adding another listener can be computed as the probability of becoming a member times the revenue expected from each member. this is a crude estimate, but it is the only information we have. using the following spreadsheet, calculate the optimal level of advertising. what is it?

advertising mr mc listeners profit

$10,000 $21 $5.00 2000 $32,000

$20,000 $21 $10.00 3386 $51,112

$21

$21

$21

at this level, the marginal cost of acquiring a customer is $21, equal to the marginal revenue of acquiring a customer. note also that as the advertising level increases its effectiveness drops. this is reflected in the marginal cost of acquiring another customer and is typical of many extent decisions. you pick the low hanging fruit first, and then you move to the more costly, higher hanging fruit.

(a) about $36,000

(b) about $40,000

(c) about $42,000

(d) about $55,000

Answers: 3

Another question on Business

Business, 21.06.2019 15:20

What is the purpose of taking a personality inventory assessment? a. to find out what personality traits you should acquire for a successful career b. to identify your personality traits and relate them to a suitable career c. to compare your personality traits with those of successful people in different careers d. to identify aspects of your personality that you can improve with the of a counselor

Answers: 3

Business, 22.06.2019 08:30

Which actions can you improve your credit score? (multiple can be selected)having a good credit score should be your prime objective as credit companies analyze your creditworthiness before giving you a loan. there are certain guidelines you can follow to ensure you have a good credit score. always pay your mortgage interest on time. if you are a student, make student loan inquiries before taking any loan. if you have multiple credit cards, manage them judiciously. maintain a healthy balance in your bank account.1. always pay your mortgage interest on time.2. if you are a student, make student loan inquiries before taking any loan.3. if you have multiple credit cards, manage them judiciously.4. maintain a healthy balance in your bank account.

Answers: 1

Business, 22.06.2019 14:40

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate.the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received.c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

Business, 22.06.2019 15:30

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

You know the right answer?

Georgetown public media is trying to determine the optimum amount for its advertising budget. calcul...

Questions

Mathematics, 19.02.2021 23:40

Mathematics, 19.02.2021 23:40

Biology, 19.02.2021 23:40

Mathematics, 19.02.2021 23:40

Biology, 19.02.2021 23:40

Mathematics, 19.02.2021 23:40

Social Studies, 19.02.2021 23:40

Mathematics, 19.02.2021 23:40

Mathematics, 19.02.2021 23:40

Mathematics, 19.02.2021 23:40