Business, 15.01.2020 07:31 mayfieldashley2437

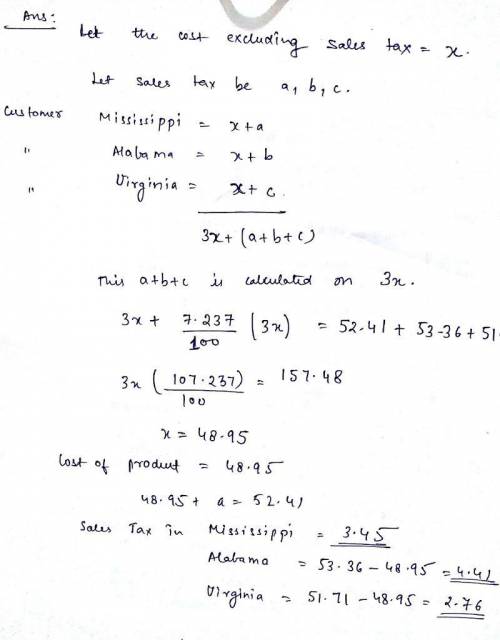

Problem 12-15 in mississippi, a customer pays $52.41 for a product (including ms state sales tax). in alabama, a customer pays $53.36 for the same product. in virginia, the customer pays $51.71 for the same product. in all three states, the sticker price (price before state sales tax is added) is the same. the average sales tax of the three states is 7.237%. determine the sales tax in each state and the cost of the product from the information given. express your answers in percent for sales tax and in dollars and cents for cost. (do not include the $ or % symbol in your answer online, only the final value with two decimal places.) (read the online version of this question carefully; it will ask for one of the values you found in a series of four questions.)

Answers: 2

Another question on Business

Business, 22.06.2019 17:40

Croy inc. has the following projected sales for the next five months: month sales in units april 3,850 may 3,875 june 4,260 july 4,135 august 3,590 croy’s finished goods inventory policy is to have 60 percent of the next month’s sales on hand at the end of each month. direct material costs $2.50 per pound, and each unit requires 2 pounds. raw materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. raw materials on hand at march 31 totaled 3,741 pounds. 1. determine budgeted production for april, may, and june. 2. determine the budgeted cost of materials purchased for april, may, and june. (round your answers to 2 decimal places.)

Answers: 3

Business, 22.06.2019 18:00

*will mark brainliest! * when a company spends resources (labor, money) to give customers "free" items, those costs are called a. investment costs b. economic costs c. scarcity costs d. opportunity costs answer asap!

Answers: 1

Business, 22.06.2019 20:10

Mikkelson corporation's stock had a required return of 12.50% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. then an increase in investor risk aversion caused the market risk premium to rise by 2%. the risk-free rate and the firm's beta remain unchanged. what is the company's new required rate of return? (hint: first calculate the beta, then find the required return.) do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 22:50

For 2016, gourmet kitchen products reported $22 million of sales and $19 million of operating costs (including depreciation). the company has $15 million of total invested capital. its after-tax cost of capital is 10%, and its federal-plus-state income tax rate was 36%. what was the firm’s economic value added (eva), that is, how much value did management add to stockholders’ wealth during 2016?

Answers: 1

You know the right answer?

Problem 12-15 in mississippi, a customer pays $52.41 for a product (including ms state sales tax). i...

Questions

Computers and Technology, 23.07.2019 21:00

Biology, 23.07.2019 21:00

English, 23.07.2019 21:00

Arts, 23.07.2019 21:00

History, 23.07.2019 21:00

Social Studies, 23.07.2019 21:00

Health, 23.07.2019 21:00

Computers and Technology, 23.07.2019 21:00

Biology, 23.07.2019 21:00