Business, 11.01.2020 03:31 cxttiemsp021

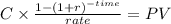

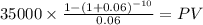

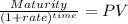

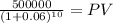

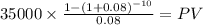

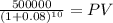

Comparing bonds issued at par, at a discount, and at a premium (ap10-2) on january 1 of this year, barnett corporation sold bonds with a face value of $500,000 and a coupon rate of 7 percent. the bonds mature in 10 years and pay interest annually on december 31. barnett uses the effective interest amortization method. ignore any tax effects. each case is independent of the other cases

required: complete the following table. the interest rates provided are the annual market rate of interest on the date the bonds were issued. case a (7%) case b (8%) case c (6%)

a. cash received at issuance

b. interest expense recorded in year 1

c. cash paid for interest in year 1 4. cash paid at maturity for bond principal

Answers: 2

Another question on Business

Business, 22.06.2019 07:40

Alicia has a collision deductible of $500 and a bodily injury liability coverage limit of $50,000. she hits another driver and injures them severely. the case goes to trial and there is a verdict to compensate the injured person for $40,000 how much does she pay?

Answers: 1

Business, 22.06.2019 20:50

You are bearish on telecom and decide to sell short 100 shares at the current market price of $50 per share. a. how much in cash or securities must you put into your brokerage account if the broker’s initial margin requirement is 50% of the value of the short position? b. how high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? (input the amount as a positive value. round your answer to 2 decimal places.)

Answers: 3

Business, 22.06.2019 23:00

Sailcloth & more currently produces boat sails and is considering expanding its operations to include awnings for homes and travel trailers. the company owns land beside its current manufacturing facility that could be used for the expansion. the company bought this land 5 years ago at a cost of $319,000. at the time of purchase, the company paid $24,000 to level out the land so it would be suitable for future use. today, the land is valued at $295,000. the company has some unused equipment that it currently owns valued at $38,000. this equipment could be used for producing awnings if $12,000 is spent for equipment modifications. other equipment costing $490,000 will also be required. what is the amount of the initial cash flow for this expansion project?

Answers: 2

Business, 23.06.2019 00:30

Emerson has an associate degree. based on the bar chart below,how will his employment opportunities change from 2008 to 2018

Answers: 2

You know the right answer?

Comparing bonds issued at par, at a discount, and at a premium (ap10-2) on january 1 of this year, b...

Questions

Health, 27.10.2020 21:10

Mathematics, 27.10.2020 21:10

English, 27.10.2020 21:10

Mathematics, 27.10.2020 21:10

Physics, 27.10.2020 21:10

Physics, 27.10.2020 21:10

History, 27.10.2020 21:10

Mathematics, 27.10.2020 21:10

World Languages, 27.10.2020 21:10

Mathematics, 27.10.2020 21:10

Computers and Technology, 27.10.2020 21:10

Mathematics, 27.10.2020 21:10

Biology, 27.10.2020 21:10