Pa5.

lo 3.3kylie’s cookies is considering the purchase of a larger oven that will cost $2,2...

Business, 08.01.2020 22:31 astridantonio225

Pa5.

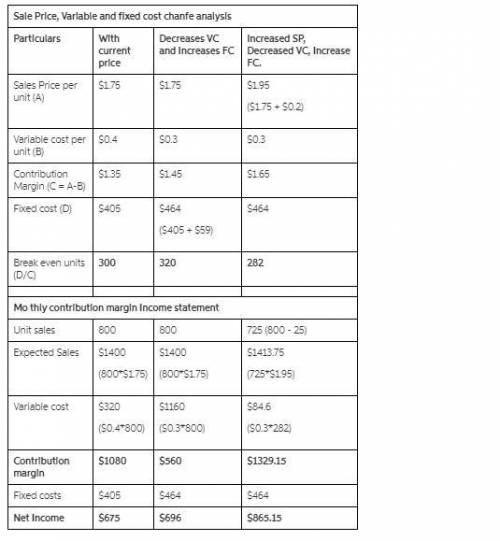

lo 3.3kylie’s cookies is considering the purchase of a larger oven that will cost $2,200 and will increase her fixed costs by $59. what would happen if she purchased the new oven to realize the variable cost savings of $0.10 per cookie, and what would happen if she raised her price by just $0.20? she feels confident that such a small price increase will decrease the sales by only 25 units and may her offset the increase in fixed costs. given the following current prices how would the break-even in units and dollars change if she doesn’t increase the selling price and if she does increase the selling price? complete the monthly contribution margin income statement for each of these cases.

Answers: 1

Another question on Business

Business, 22.06.2019 11:20

Money aggregates identify whether each of the following examples belongs in m1 or m2. if an example belongs in both, be sure to check both boxes. example m1 m2 gilberto has a roll of quarters that he just withdrew from the bank to do laundry. lorenzo has $25,000 in a money market account. neha has $8,000 in a two-year certificate of deposit (cd).

Answers: 3

Business, 22.06.2019 21:00

Frost corporation incurred the following transactions during its first year of operations. (assume all transactions involve cash.) 1) acquired $1,900 of capital from the owners. 2) purchased $435 of direct raw materials. 3) used $290 of these direct raw materials in the production process. 4) paid production workers $490 cash. 5) paid $290 for manufacturing overhead (applied and actual overhead are the same). 6) started and completed 250 units of inventory. 7) sold 140 units at a price of $6 each. 8) paid $130 for selling and administrative expenses. the amount of raw material inventory on the balance sheet at the end of the accounting period would be:

Answers: 3

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 2

Business, 23.06.2019 03:00

What is the w-4 form used for? filing taxes with the federal government determining the amount of money an employee has paid out in taxes calculating how much tax should be withheld from a person’s paycheck calculating how much income was paid in the previous year

Answers: 1

You know the right answer?

Questions

Mathematics, 21.03.2021 16:30

Mathematics, 21.03.2021 16:30

Computers and Technology, 21.03.2021 16:30

Mathematics, 21.03.2021 16:40

English, 21.03.2021 16:40

Mathematics, 21.03.2021 16:40

English, 21.03.2021 16:40

English, 21.03.2021 16:40

Social Studies, 21.03.2021 16:40

Social Studies, 21.03.2021 16:40