Business, 08.01.2020 06:31 natasniebow

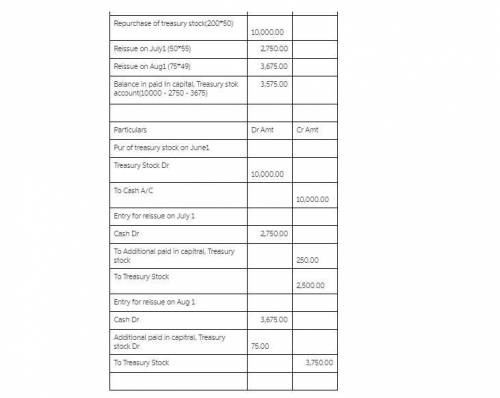

1- prior to june 1, a company has never had any treasury stock transactions. a company repurchased 200 shares of its $10 par common stock on june 1 for $50 per share on july 1, it reissued 50 of these shares at $55 per share. what is the credit to paid in capital, treasury stock required to record this event? 2- prior to june 1, a company has never had any treasury stock transactions. a company repurchased 200 shares of its $10 par common stock on june 1 for $50 per share on july 1, it reissued 50 of these shares at $55 per share. on august 1, it reissued 75 treasury shares at $49 per share. what is the balance in the paid-in capital, treasury stock account on august 2 after all of the events in this and the last two questions are recorded?

Answers: 1

Another question on Business

Business, 22.06.2019 08:00

Shrieves casting company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by sidney johnson, a recently graduated mba. the production line would be set up in unused space in the main plant. the machinery’s invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. the machinery has an economic life of 4 years, and shrieves has obtained a special tax ruling that places the equipment in the macrs 3-year class. the machinery is expected to have a salvage value of $25,000 after 4 years of use. the new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. each unit can be sold for $200 in the first year. the sales price and cost are both expected to increase by 3% per year due to inflation. further, to handle the new line, the firm’s net working capital would have to increase by an amount equal to 12% of sales revenues. the firm’s tax rate is 40%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 10%. define “incremental cash flow.” (1) should you subtract interest expense or dividends when calculating project cash flow?

Answers: 1

Business, 22.06.2019 16:20

Carlos hears juan and rita’s complaints about the new employees with whom they have to work with, as well as their threats to quit the company. if carlos were to reassign juan and rita to new, unique roles and separate them from the ronny and bill, it would signal that carlos has moved into the stage of managing resistance.

Answers: 3

Business, 22.06.2019 19:10

Greenway industries is a major multinational conglomerate. its business units compete in a range of industries, including home appliances, pharmaceuticals, commercial real estate, and plastics manufacturing. although its largest business unit, which produces kitchen appliances, is among the most profitable in the industry, it generates only 35 percent of the company's revenues. which of the following is most likely true of greenway's stock price? a. it is valued at less than the sum of its individual business units. b. it is valued at greater than the sum of individual business units. c. it is valued at the exact sum of individual business units. d. it is consistently lower than the industry average.it is valued at greater than the sum of individual business units.

Answers: 1

Business, 22.06.2019 23:00

The era of venture capitalists doling out large sums of money to startups is a. just beginning b. on the rise c. over d. fading

Answers: 2

You know the right answer?

1- prior to june 1, a company has never had any treasury stock transactions. a company repurchased 2...

Questions

Mathematics, 27.03.2020 00:25

English, 27.03.2020 00:25

Mathematics, 27.03.2020 00:25

Mathematics, 27.03.2020 00:25

Mathematics, 27.03.2020 00:25