Business, 08.01.2020 01:31 flowersthomas1969

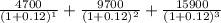

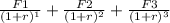

Marko, inc. is considering the purchase of abc co. marko believes that abc co. can generate cash flows of $4,700, $9,700, and $15,900 over the next three years, respectively. after that time, they feel the business will be worthless. marko has determined that a rate of return of 12 percent is applicable to this potential purchase. what is marko willing to pay today to buy abc co.?

Answers: 1

Another question on Business

Business, 21.06.2019 17:40

Find the expected net profit of an insurance company on a health-insurance policy if: the probability of a $5000 claim is 20%; the probability of a $1000 claim is 60%; the probability of a $20,000 claim is 10%, and the probability of no claim is 10%. the company charges $4000 for this coverage. interpret your answer.

Answers: 3

Business, 21.06.2019 22:30

Match the vocabulary word to the correct definition. 1. compensation 2. corporate social responsibility 3. discrimination 4. benefits 5. biodegradable a. a business’s obligation to the community and the environment b. the ability to naturally break down or decompose c. treating someone differently because of his or her race, religion,gender, sexual orientation, or disabilities d. indirect and non-cash compensation paid to employees e. the salary and other benefits for doing a job

Answers: 1

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 23.06.2019 03:20

Name successful entrepreneurs from your area whose business is related to cookery

Answers: 1

You know the right answer?

Marko, inc. is considering the purchase of abc co. marko believes that abc co. can generate cash flo...

Questions

English, 19.08.2021 02:30

Mathematics, 19.08.2021 02:30

Mathematics, 19.08.2021 02:30

Geography, 19.08.2021 02:30

History, 19.08.2021 02:30

Mathematics, 19.08.2021 02:30

Mathematics, 19.08.2021 02:40

Mathematics, 19.08.2021 02:40

Physics, 19.08.2021 02:40

Mathematics, 19.08.2021 02:40

Mathematics, 19.08.2021 02:40

..........................1

..........................1