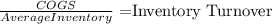

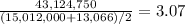

Pascarella inc. is revising its payables policy. it has annual sales of $50,735,000, an average inventory level of $15,012,000, and average accounts receivable of $10,008,000. the firm's cost of goods sold is 85% of sales. the company makes all purchases on credit and has always paid on the 30th day. however, it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day. the cfo also believes that sales can be maintained at the existing level but inventory can be lowered by $1,946,000 and accounts receivable by $1,946,000. what will be the net change in the cash conversion cycle, assuming a 365-day year

Answers: 1

Another question on Business

Business, 22.06.2019 10:00

Which term best fits the sentence? is the process of reasoning, analyzing, and making important decisions. it’s an important skill in making career decisions. a. critical thinking b. weighing pros and cons c. goal setting

Answers: 1

Business, 22.06.2019 17:00

Zeta corporation is a manufacturer of sports caps, which require soft fabric. the standards for each cap allow 2.00 yards of soft fabric, at a cost of $2.00 per yard. during the month of january, the company purchased 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. what is zeta corporation's materials price variance for the month of january?

Answers: 2

Business, 22.06.2019 21:40

Which of the following is one of the main causes of inflation? a. wages drop so workers have to spend a higher percentage of income on necessities. b. demand drops and forces producers to charge more to meet their costs. c. rising unemployment cuts into national income. d. consumers demand goods faster than they can be supplied.

Answers: 3

Business, 22.06.2019 23:50

Analyzing operational changes operating results for department b of delta company during 2016 are as follows: sales $540,000 cost of goods sold 378,000 gross profit 162,000 direct expenses 120,000 common expenses 66,000 total expenses 186,000 net loss $(24,000) suppose that department b could increase physical volume of product sold by 10% if it spent an additional $18,000 on advertising while leaving selling prices unchanged. what effect would this have on the department's net income or net loss? (ignore income tax in your calculations.) use a negative sign to indicate a net loss answer; otherwise do not use negative signs with your answers. sales $answer cost of goods sold answer gross profit answer direct expenses answer common expenses answer total expenses answer net income (loss) $answer

Answers: 1

You know the right answer?

Pascarella inc. is revising its payables policy. it has annual sales of $50,735,000, an average inve...

Questions

English, 23.03.2020 20:26

Geography, 23.03.2020 20:26

Computers and Technology, 23.03.2020 20:26

Chemistry, 23.03.2020 20:26

Mathematics, 23.03.2020 20:26

Mathematics, 23.03.2020 20:26

French, 23.03.2020 20:26