Business, 24.12.2019 19:31 thegoat3180

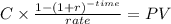

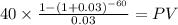

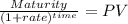

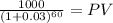

Acompany has an 8% bond that has a face value of $1,000 and matures in 30 years. assume that coupon payments are made semi-annually. the bonds are callable after 15 years at 108% of par value. what is the value of the bond if rates drop immediately to 6%? a. $1,277b. $2,192c. $1,452d. $1,229e. $602

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

Write two goals for yourself that will aid you in pursuing your post-secondary education or training. with this

Answers: 1

Business, 21.06.2019 18:30

Beta coefficients and the capital asset pricing model personal finance problem katherine wilson is wondering how much risk she must undertake to generate an acceptable return on her porfolio. the risk-free return currently is 4%. the return on the overall stock market is 14%. use the capm to calculate how high the beta coefficient of katherine's portfolio would have to be to achieve a portfolio return of 16%.

Answers: 2

Business, 22.06.2019 12:30

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 15:40

Colter steel has $5,550,000 in assets. temporary current assets $ 3,100,000 permanent current assets 1,605,000 fixed assets 845,000 total assets $ 5,550,000 assume the term structure of interest rates becomes inverted, with short-term rates going to 10 percent and long-term rates 2 percentage points lower than short-term rates. earnings before interest and taxes are $1,170,000. the tax rate is 40 percent earnings after taxes = ?

Answers: 1

You know the right answer?

Acompany has an 8% bond that has a face value of $1,000 and matures in 30 years. assume that coupon...

Questions

Social Studies, 07.11.2020 04:10

Advanced Placement (AP), 07.11.2020 04:10

Mathematics, 07.11.2020 04:10

Biology, 07.11.2020 04:10

Mathematics, 07.11.2020 04:10

History, 07.11.2020 04:10

Mathematics, 07.11.2020 04:10

History, 07.11.2020 04:10

Mathematics, 07.11.2020 04:10

Chemistry, 07.11.2020 04:10

Chemistry, 07.11.2020 04:10

Social Studies, 07.11.2020 04:10

English, 07.11.2020 04:10

Biology, 07.11.2020 04:10

Geography, 07.11.2020 04:10

Social Studies, 07.11.2020 04:10