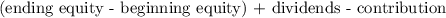

Acorporation had the following assets and liabilities at the beginning and end of this year. assets liabilities beginning of the year $ 60,000 $ 20,000 end of the year 105,000 36,000 a. owner made no investments in the business, and no dividends were paid during the year. b. owner made no investments in the business, but dividends were $1,250 cash per month. c. no dividends were paid during the year, but the owner did invest an additional $55,000 cash in exchange for common stock. d. dividends were $1,250 cash per month, and the owner invested an additional $35,000 cash in exchange for common stock. determine the net income earned or net loss incurred by the business during the year for each of the above separate cases: (decreases in equity should be indicated with a minus sign.)

Answers: 1

Another question on Business

Business, 22.06.2019 23:00

Investors who put their own money into a startup are known as a. mannequins b. obligators c. angels d. borrowers

Answers: 1

Business, 22.06.2019 23:10

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter.required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

Business, 23.06.2019 01:30

James jones is the owner of a small retail business operated as a sole proprietorship. during 2017, his business recorded the following items of income and expense: revenue from inventory sales $ 147,000 cost of goods sold 33,500 business license tax 2,400 rent on retail space 42,000 supplies 15,000 wages paid to employees 22,000 payroll taxes 1,700 utilities 3,600 compute taxable income attributable to the sole proprietorship by completing schedule c to be included in james’s 2017 form 1040. compute self-employment tax payable on the earnings of james’s sole proprietorship by completing a 2017 schedule se, form 1040. assume your answers to parts a and b are the same for 2018. further assume that james's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. calculate james's 2018 section 199a deduction.

Answers: 1

You know the right answer?

Acorporation had the following assets and liabilities at the beginning and end of this year. assets...

Questions

History, 14.12.2020 09:10

English, 14.12.2020 09:10

Mathematics, 14.12.2020 09:10

History, 14.12.2020 09:10

English, 14.12.2020 09:10

Mathematics, 14.12.2020 09:10

Social Studies, 14.12.2020 09:10

Biology, 14.12.2020 09:10

Mathematics, 14.12.2020 09:10

Mathematics, 14.12.2020 09:10

Mathematics, 14.12.2020 09:10

Chemistry, 14.12.2020 09:10

History, 14.12.2020 09:10

Mathematics, 14.12.2020 09:10