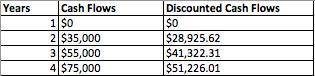

Ginny trueblood is considering an investment which will cost her $120,000. the investment produces no cash flows for the first year. in the second year the cash inflow is $35,000. this inflow will increase to $55,000 and then $75,000 for the following two years before ceasing permanently. ginny requires a 10% rate of return and has a required discounted payback period of three years. ginny should this project because the discounted payback period . a. accept; 2.03 years b. accept; 2.97 years c. accept; 3.97 years d. reject; 3.03 years e. reject; 3.97 years

Answers: 2

Another question on Business

Business, 21.06.2019 15:30

Suppose that each country completely specializes in the production of the good in which it has a comparative advantage, producing only that good. in this case, the country that produces jeans will produce 32 million pairs per month, and the country that produces corn will produce 32 million bushels per month.

Answers: 1

Business, 21.06.2019 20:40

Which of the following best explains how the invention of money affected the barter system? a. the invention of money supplemented the barter system by providing a nonperishable medium of exchange b. the invention of money completely replaced the barter system with a free-market system c. the invention of money had no effect on the barter system d. the invention of money drastically reduced the value of goods used in the barter system 2b2t

Answers: 3

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 10:10

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

You know the right answer?

Ginny trueblood is considering an investment which will cost her $120,000. the investment produces n...

Questions

Biology, 05.05.2020 05:44

Mathematics, 05.05.2020 05:44

English, 05.05.2020 05:44

Geography, 05.05.2020 05:44

Mathematics, 05.05.2020 05:44

Geography, 05.05.2020 05:44

Mathematics, 05.05.2020 05:44

History, 05.05.2020 05:44

Mathematics, 05.05.2020 05:44

Mathematics, 05.05.2020 05:44

Geography, 05.05.2020 05:44

Biology, 05.05.2020 05:44

History, 05.05.2020 05:44