Business, 19.12.2019 21:31 robert7248

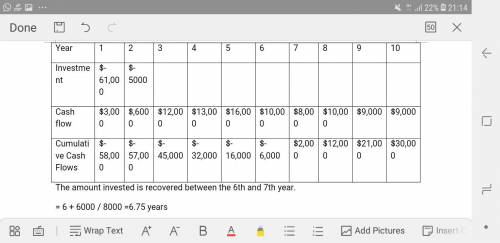

The management of unter corporation, an architectural design firm, is considering an investment with the following cash flows: year investment cash inflow 1 $61,000 $3,000 2 $5,000 $6,000 3 $12,000 4 $13,000 5 $16,000 6 $10,000 7 $8,000 8 $10,000 9 $9,000 10 $9,000 required: 1. determine the payback period of the investment. (round your answer to 1 decimal place.) 2. would the payback period be affected if the cash inflow in the last year were several times as large? yes no

Answers: 1

Another question on Business

Business, 21.06.2019 19:10

The development price itself is such a huge barrier, it's just a very different business model than boeing's used to. our huge development programs are typically centered around commercial airplanes, military aircraft, where there is a lot of orders. and right now the foundation of the business is two bites a year.

Answers: 3

Business, 21.06.2019 20:30

Andrew cooper decides to become a part owner of a corporation. as a part owner, he expects to receive a profit as payment because he has assumed the risk of - serious inflation eroding the purchasing power of his investment.- being paid before the suppliers and employees are paid.- losing his home, car, and life savings.- losing the money he has invested in the corporation and not receiving profits.- the company giving all of the profits to local communities

Answers: 2

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 19:30

The owner of firewood to go is considering buying a hydraulic wood splitter which sells for $50,000. he figures it will cost an additional $100 per cord to purchase and split wood with this machine, while he can sell each cord of split wood for $125. if, for this machine, design capacity is 50 cords per day, effective capacity is 40 cords per day, and actual output is expected to be 32 cords per day, what would be its efficiency?

Answers: 1

You know the right answer?

The management of unter corporation, an architectural design firm, is considering an investment with...

Questions

English, 21.04.2020 02:19

History, 21.04.2020 02:20

Mathematics, 21.04.2020 02:20

Mathematics, 21.04.2020 02:20

Mathematics, 21.04.2020 02:21

Mathematics, 21.04.2020 02:21

Mathematics, 21.04.2020 02:21