Business, 19.12.2019 00:31 emmarieasimon

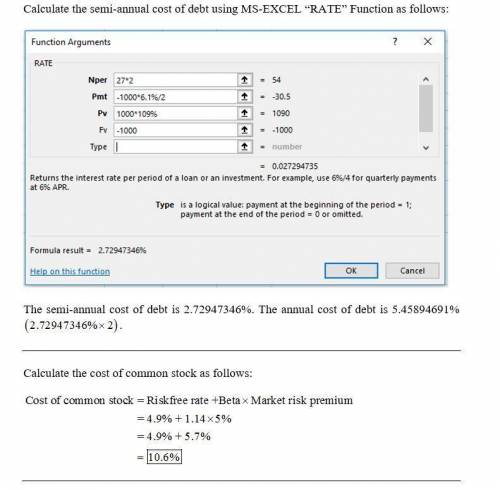

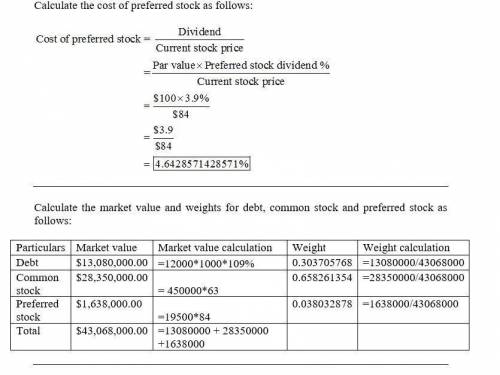

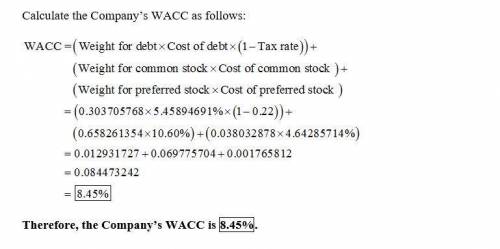

You are given the following information for lightning power co. assume the company’s tax rate is 22 percent. debt: 12,000 6.1 percent coupon bonds outstanding, $1,000 par value, 27 years to maturity, selling for 109 percent of par; the bonds make semiannual payments. common stock: 450,000 shares outstanding, selling for $63 per share; beta is 1.14. preferred stock: 19,500 shares of 3.9 percent preferred stock outstanding, currently selling for $84 per share. the par value is $100 per share. market: 5 percent market risk premium and 4.9 percent risk-free rate. what is the company's wacc?

Answers: 3

Another question on Business

Business, 21.06.2019 19:50

Which of the following best explains why treasury bonds have an effect on the size of the money supply? a. the amount of treasury bonds in circulation affects both unemployment and inflation. b. the government can spend more money and charge lower taxes by using treasury bonds. c. the federal reserve bank can buy and sell these bonds to raise or lower bank deposits. d. the interest paid on treasury bonds influences the interest rates charged by private banks. 2b2t

Answers: 1

Business, 22.06.2019 06:00

According to herman, one of the differences of managing a nonprofit versus a for-profit corporation is

Answers: 1

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 23:00

You cannot make copies of media, even as a personal backup, without violating copyright. true

Answers: 3

You know the right answer?

You are given the following information for lightning power co. assume the company’s tax rate is 22...

Questions

Chemistry, 04.06.2020 23:07

Biology, 04.06.2020 23:07

Mathematics, 04.06.2020 23:07

Mathematics, 04.06.2020 23:07

Mathematics, 04.06.2020 23:07

History, 04.06.2020 23:07