Business, 18.12.2019 06:31 FombafTejanjr3923

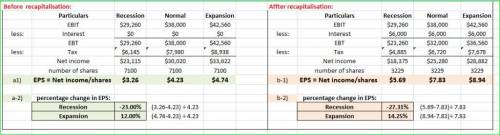

Ghost, inc., has no debt outstanding and a total market value of $220,100. earnings before interest and taxes, ebit, are projected to be $38,000 if economic conditions are normal. if there is strong expansion in the economy, then ebit will be 12 percent higher. if there is a recession, then ebit will be 23 percent lower. the company is considering a $120,000 debt issue with an interest rate of 5 percent. the proceeds will be used to repurchase shares of stock. there are currently 7,100 shares outstanding. the company has a tax rate of 21 percent, a market-to-book ratio of 1.0, and the stock price remains constant. a-1. calculate earnings per share (eps) under each of the three economic scenarios before any debt is issued. (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)a-2. calculate the percentage changes in eps when the economy expands or enters a recession. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)b-1. calculate earnings per share (eps) under each of the three economic scenarios assuming the company goes through with recapitalization. (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)b-2. given the recapitalization, calculate the percentage changes in eps when the economy expands or enters a recession. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 2

Another question on Business

Business, 22.06.2019 21:40

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

Business, 23.06.2019 01:50

The de mesa family will soon be occupying their newly renovated house. however, the bathroom measuring 10ft. by 16 ft. still needs to be covered by tiles. if the tile that they desire measures 2/5 ft by 2/5 ft., how many tiles will they need to cover the bathroom floor?

Answers: 3

Business, 23.06.2019 07:40

S. you are changing planes in london for a flight to paris where you will connect with your flight to capetown. you are picking up reading material for the flight and are looking at the prices listed on the economist magazine which conveniently lists prices in several different global currencies. you note that the price in pounds is 2.40 pounds and the price in euros is 2 euros. the exchange rate for the dollar (your credit card was issued in the usa) is $1.59/pound and s1.3837/euro. should you buy reading materials now or wait until you're in paris?

Answers: 3

Business, 23.06.2019 09:30

Craig complained to his friend jess that a class was too hard and he believed that the teacher was not being fair with his grading standards. jess replied, "craig, you really have an attitude problem." what is the relationship between the manner that the term attitude is used in common conversation and the how it is defined in consumer behavior? there is no relationship. common usage is not the same as attitudes as seen by the researchers who study consumer behavior. the term attitude is widely used in popular culture in much the same way it is used in studying consumer behavior. they are different in that popular culture does not recognize that attitudes are temporary. otherwise the usage is the same. they are similar except that popular culture assumes that attitudes are related to beliefs, and research scientists have shown that there is no such relationship.

Answers: 2

You know the right answer?

Ghost, inc., has no debt outstanding and a total market value of $220,100. earnings before interest...

Questions

Social Studies, 13.01.2023 03:40

Mathematics, 13.01.2023 04:10

History, 13.01.2023 15:50

Mathematics, 13.01.2023 18:00

Health, 14.01.2023 05:00

Social Studies, 14.01.2023 09:00

Mathematics, 14.01.2023 14:00

Mathematics, 15.01.2023 09:20