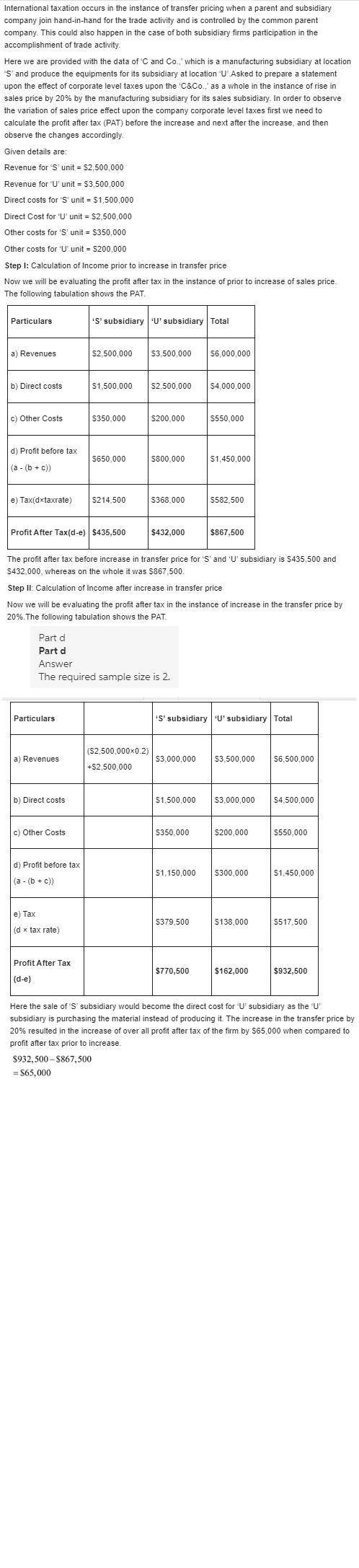

Transfer pricing; international taxation crain company has a manufacturing subsidiary in singapore that produces high- end exercise equipment for u. s. consumers. the manufacturing subsidiary has total manufacturing costs of $1,500,ooo, plus general and administrative expenses of $350,000. the manufacturing unit sells the equipment for $2,500,000 to the u. s. marketing subsidiary, which sells it to the final consumer for an aggregate of the sales subsidiary has total marketing, general, and administrative costs of $200,000. assume that singapore has a corporate tax rate of 33% and that the u. s. tax rate is 46%. assume that no tax treaties or other special tax treatments apply.

required: what is the effect on crain company's total corporate-level taxes if the manufacturing subsidiary raises its price to the sales subsidiary by 20%?

Answers: 2

Another question on Business

Business, 22.06.2019 06:00

Josie just bought her first fish tank a 36 -gallon glass aquarium, which she’s been saving up for almost a year to buy. for josie, the fish tank is most likely what type of purchase

Answers: 1

Business, 22.06.2019 06:40

After the 2008 recession, the amount of reserves in the us banking system increased. because of federal reserve actions, required reserves increased from $44 billion to $60 billion. however, banks started holding more reserves than required. by january 2009, banks were holding $900 billion in excess reserves. the federal reserve started paying interest on the excess reserves that the banks held. what possible impact will these unused reserves have on the economy?

Answers: 1

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 12:30

In the 1970s, kmart used blue light specials to encourage customers to flock to a particular department having a temporary sale. a spinning blue light activated for approximately 30 seconds, and then an in-store announcement informed shoppers of the special savings in the specific department. over time, loyal kmart shoppers learned to flock to the department with the spinning blue light before any announcement of special savings occurred. if kmart was employing classical conditioning techniques, what role did the spinning blue light play?

Answers: 3

You know the right answer?

Transfer pricing; international taxation crain company has a manufacturing subsidiary in singapore...

Questions

Computers and Technology, 02.03.2020 16:54

History, 02.03.2020 16:55