Business, 17.12.2019 05:31 hoolio4495

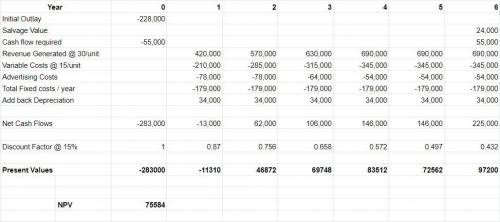

Matheson electronics has just developed a new electronic device that it believes will have broad market appeal. the company has performed marketing and cost studies that revealed the following information: a. new equipment would have to be acquired to produce the device. the equipment would cost $228,000 and have a six-year useful life. after six years, it would have a salvage value of about $24,000.b. sales in units over the next six years are projected to be as follows: year sales in units1 14,0002 19,0003 21,0004–6 23,000c. production and sales of the device would require working capital of $55,000 to finance accounts receivable, inventories, and day-to-day cash needs. this working capital would be released at the end of the project’s life. d. the devices would sell for $30 each; variable costs for production, administration, and sales would be $15 per unit. e. fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $179,000 per year. (depreciation is based on cost less salvage value.)f. to gain rapid entry into the market, the company would have to advertise heavily. the advertising costs would be: year amount of yearlyadvertising1–2 $ 78,000 3 $ 64,000 4–6 $ 54,000 g. the company’s required rate of return is 15%.click here to view exhibit 13b-1 and exhibit 13b-2, to determine the appropriate discount factor(s) using tables. required: 1. compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years.2-a. using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment.2-b. would you recommend that matheson accept the device as a new product?

Answers: 1

Another question on Business

Business, 22.06.2019 04:00

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 11:50

The following are the current month's balances for abc financial services, inc. before preparing the trial balance. accounts payable $ 10,000 revenue 6,000 cash 3,000 expenses 17,500 furniture 10,000 accounts receivable 14,000 common stock ? notes payable 6,500 what amount should be shown for common stock on the trial balance? a. $48.000b. $12.500c. $27.000d. $28.000

Answers: 3

Business, 22.06.2019 14:20

Jaynet spends $50,000 per year on painting supplies and storage space. she recently received two job offers from a famous marketing firm – one offer was for $95,000 per year, and the other was for $120,000. however, she turned both jobs down to continue a painting career. if jaynet sells 35 paintings per year at a price of $6,000 each: a. what are her accounting profits? b. what are her economic profits?

Answers: 1

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

You know the right answer?

Matheson electronics has just developed a new electronic device that it believes will have broad mar...

Questions

Mathematics, 05.03.2022 05:40

Biology, 05.03.2022 05:40

Computers and Technology, 05.03.2022 05:40

Social Studies, 05.03.2022 05:40

Mathematics, 05.03.2022 05:40

Chemistry, 05.03.2022 05:40

Social Studies, 05.03.2022 05:40

Social Studies, 05.03.2022 05:40

History, 05.03.2022 05:50

History, 05.03.2022 05:50