Business, 17.12.2019 05:31 kaiyakunkle

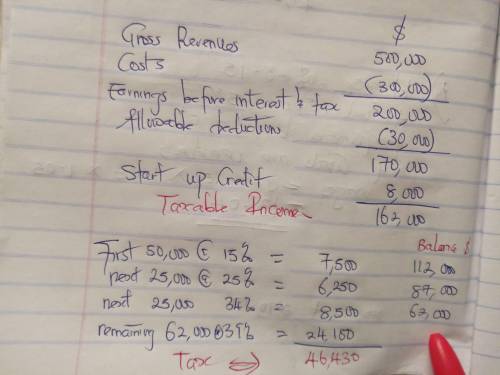

Acompany wants to set up a new office in a country where the corporate tax rate is as follows:

15% of first $50,000 profits, 25% of next $25,000, 34% of next $25,000, and 39% of everything over $100,000.

executives estimate that they will have gross revenues of $500,00, total costs of $300,000, $30,000 in allowable tax deductions, and a one time business start-up credit of $8,000.

what is taxable income for the first year, and how much should the company expect to pay in taxes?

Answers: 3

Another question on Business

Business, 22.06.2019 11:40

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 22.06.2019 19:40

Banana computers has decided to procure processing chips required for its laptops from external suppliers instead of manufacturing them in their own facilities. how will this decision affect the firm? a. the firm will be protected against the principal-agent problem. b. the firm's administrative costs will be low because of necessary bureaucracy. c. the firm will have more flexibility in purchasing and comparing prices of goods and services. d. the firm will have high-powered incentives, such as hourly wages and salaries.

Answers: 3

Business, 22.06.2019 22:20

Which of the following is one disadvantage of renting a place to live compared to buying a home? a. tenants have to pay for all repairs to the building. b. the landlord covers the expenses of maintaining the property. c. residents can't alter their living space without permission. d. rent is generally more than monthly mortgage payments.

Answers: 1

You know the right answer?

Acompany wants to set up a new office in a country where the corporate tax rate is as follows:

Questions

Biology, 11.12.2020 03:50

Mathematics, 11.12.2020 03:50

Spanish, 11.12.2020 03:50

Biology, 11.12.2020 03:50

Computers and Technology, 11.12.2020 03:50

Mathematics, 11.12.2020 03:50

History, 11.12.2020 03:50

English, 11.12.2020 03:50

Medicine, 11.12.2020 03:50

Mathematics, 11.12.2020 03:50