Business, 14.12.2019 03:31 gisellekarime

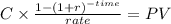

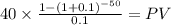

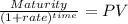

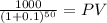

A$1,000 par value bond was issued five years ago at a 8 percent coupon rate. it currently has 25 years remaining to maturity. interest rates on similar debt obligations are now 10 percent. use appendix b and appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. compute the current price of the bond using an assumption of semiannual payments. (do not round intermediate calculations and round your answer to 2 decimal places.) b. if mr. robinson initially bought the bond at par value, what is his percentage capital gain or loss? (ignore any interest income received. do not round intermediate calculations and input the amount as a positive percent rounded to 2 decimal places.) c. now assume mrs. pinson buys the bond at its current market value and holds it to maturity, what will be her percentage capital gain or loss? (ignore any interest income received. do not round intermediate calculations and input the amount as a positive percent rounded to 2 decimal places.) d. why is the percentage gain larger than the percentage loss when the same dollar amounts are involved in parts b and c? the percentage gain is larger than the percentage loss because the investment is larger. the percentage gain is larger than the percentage loss because the investment is smaller.

Answers: 3

Another question on Business

Business, 22.06.2019 10:00

Marco works in the marketing department of a luxury fashion brand. he is making a presentation on the success of a recent marketing campaign that included a fashion show. which slide elements can he use to include photographs and footage of the fashion show in his presentation? marco can use the: table images audio option to include photographs and the: flowcharts images video option to include footage of the fashion show.

Answers: 1

Business, 23.06.2019 03:20

Suppose that fixed costs for a firm in the automobile industry (start-up costs of factories, capital equipment, and so on) are $5 billion and that variable costs are equal to $17,000 per finished automobile. because more firms increase competition in the market, the market price falls as more firms enter an automobile market, or specifically, , where n represents the number of firms in a market. assume that the initial size of the u.s. and the european automobile markets are 300 million and 533 million people, respectively.a. calculate the equilibrium number of firms in the u.s. and european automobile markets without trade.b. what is the equilibrium price of automobiles in the united states and europe if the automobile industry is closed to foreign trade? c. now suppose that the united states decides on free trade in automobiles with europe. the trade agreement with the europeans adds 533 million consumers to the automobile market, in addition to the 300 million in the united states. how many automobile firms will there be in the united states and europe combined? what will be the new equilibrium price of automobiles? d. why are prices in the united states different in (c) and (b)? are consumers better off with free trade? in what ways?

Answers: 1

Business, 23.06.2019 04:00

Estimate the prouduct sovle using an area modelestimate the product you solve using an area model and the standard algorithm.remeber to express your products in the standard form

Answers: 3

Business, 23.06.2019 09:50

The goal of an economist who formulates new theories is to a. provide an interesting framework of analysis, whether or not the framework turns out to be of much use in understanding how the world works. b. provoke stimulating debate in scientific journals. c. contribute to an understanding of how the world works. d. demonstrate that economists, like other scientists, can formulate testable theories.

Answers: 1

You know the right answer?

A$1,000 par value bond was issued five years ago at a 8 percent coupon rate. it currently has 25 yea...

Questions

Social Studies, 12.02.2022 09:40

Social Studies, 12.02.2022 09:50

History, 12.02.2022 09:50

Mathematics, 12.02.2022 09:50

Social Studies, 12.02.2022 09:50