Business, 14.12.2019 02:31 ryleepretty

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target capital structure. currently it targets a 50-50 mix of debt and equity, but it is considering a target capital structure with 70% debt. american exploration currently has 6% after-tax cost of debt and a 12% cost of common stock. the company does not have any preferred stock outstanding.

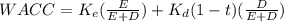

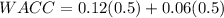

a. what is american exploration's current wacc?

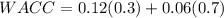

b. assuming that its cost of debt and equity remain unchanged, what will be american exploration's wacc under the revised target capital structure?

c. do you think shareholders are affected by the increase in debt to 70%? if so, how are they affected? are the common stock claims riskier now?

d. suppose that in response to the increase in debt, american exploration's shareholders increase their required return so that cost of common equity is 16%. what will its new wacc be in this case?

e. what does your answer in part d suggest about the tradeoff between financing with debt versus equity?

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

The following cost data relate to the manufacturing activities of chang company during the just completed year: manufacturing overhead costs incurred: indirect materials $ 15,800 indirect labor 138,000 property taxes, factory 8,800 utilities, factory 78,000 depreciation, factory 150,600 insurance, factory 10,800 total actual manufacturing overhead costs incurred $ 402,000 other costs incurred: purchases of raw materials (both direct and indirect) $ 408,000 direct labor cost $ 68,000 inventories: raw materials, beginning $ 20,800 raw materials, ending $ 30,800 work in process, beginning $ 40,800 work in process, ending $ 70,800 the company uses a predetermined overhead rate of $20 per machine-hour to apply overhead cost to jobs. a total of 20,500 machine-hours were used during the year. required: 1. compute the amount of underapplied or overapplied overhead cost for the year. 2. prepare a schedule of cost of goods manufactured for the year.

Answers: 3

Business, 21.06.2019 21:50

You have $22,000 to invest in a stock portfolio. your choices are stock x with an expected return of 11 percent and stock y with an expected return of 13 percent. if your goal is to create a portfolio with an expected return of 11.74 percent, how much money will you invest in stock x? in stock y?

Answers: 2

Business, 22.06.2019 16:50

Arestaurant that creates a new type of sandwich is using (blank) as a method of competition.

Answers: 1

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

You know the right answer?

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target...

Questions

History, 21.01.2021 04:40

Mathematics, 21.01.2021 04:40

Mathematics, 21.01.2021 04:40

Mathematics, 21.01.2021 04:40

Mathematics, 21.01.2021 04:40

Health, 21.01.2021 04:40

Mathematics, 21.01.2021 04:40

Arts, 21.01.2021 04:40

History, 21.01.2021 04:40

Chemistry, 21.01.2021 04:40

Mathematics, 21.01.2021 04:40