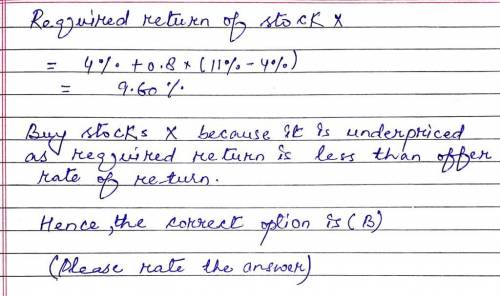

The risk-free rate is 4%. the expected market rate of return is 11%. if you expect stock x with a beta of .8 to offer a rate of return of 12 percent, then you should

a) buy stock x because it is overpriced

b) buy stock x because it is underpriced

c) sell short stock x because it is overpriced

d) sell short stock x because it is underpriced

e) stock x is correctly priced

Answers: 1

Another question on Business

Business, 22.06.2019 15:30

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

Business, 22.06.2019 20:00

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

Business, 23.06.2019 02:00

Donna and gary are involved in an automobile accident. gary initiates a lawsuit against donna by filing a complaint. if donna files a motion to dismiss, she is asserting that

Answers: 2

Business, 23.06.2019 14:00

Explain the law of diminishing marginal utility as the basis for the slope of the travellers demand curve

Answers: 2

You know the right answer?

The risk-free rate is 4%. the expected market rate of return is 11%. if you expect stock x with a be...

Questions

Social Studies, 29.01.2020 00:06

Biology, 29.01.2020 00:06

Mathematics, 29.01.2020 00:06

Physics, 29.01.2020 00:06

English, 29.01.2020 00:06

Biology, 29.01.2020 00:06

Mathematics, 29.01.2020 00:06

English, 29.01.2020 00:06

Mathematics, 29.01.2020 00:06

Geography, 29.01.2020 00:06