Business, 12.12.2019 04:31 Loggtech24

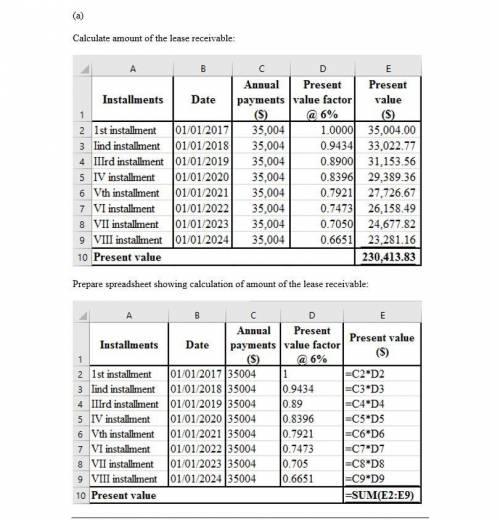

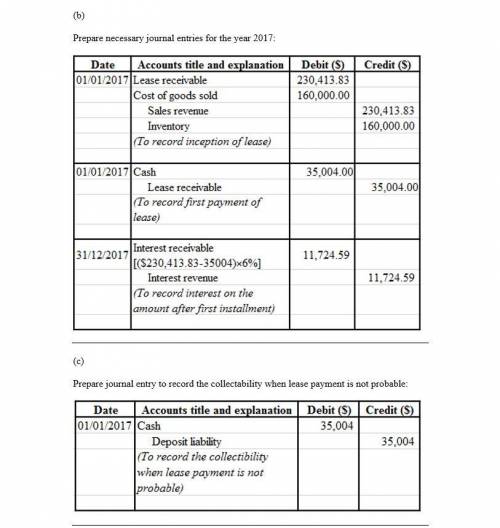

E21-8 (l02,4) excel (lessor entries; sales-type lease) crosley company, a machinery dealer, leased a machine to dexter corporation on january 1, 2017. the lease is for an 8-year period and requires equal annual payments of $35,004 at the beginning of each year. the first payment is received on january 1, 2017. crasley had purchased the machine during 2016 for 160,000. collectiblity of lease payments by crosley is probable. crosley set the annual rental to ensure a 6"a rate of return. the machine has an economic life of 10 years with no residual value and nuverts to crosley at the termination of the lease instructions a) compute the amount of the lease receivable. (b) prepare all necussary journal entries for crosley for 2017 lc) suppose the collectibility of the lease payments was not probable for crosley prepare all necessary journal entries for the company in 2017 (d) suppose at the end of the lease term, crosley receives thesset and delermines that it actually has a fair value of s1,000 inslead of the anticipaled residual value of s0. record the entry to recognize the receipt of the asset for crosley at the end of the lease term

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

Excel allows you to take a lot of data and organize it in one document. what are some of the features you can use to clarify, emphasize, and differentiate your data?

Answers: 2

Business, 22.06.2019 07:30

Most states have licensing registration requirements for child care centers and family daycare homes. these usually include minimum standard for operation. which of the following would you most likely find required in a statement of state licensing standards for child care centers?

Answers: 2

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 16:40

Shawn received an e-mail offering a great deal on music, movie, and game downloads. he has never heard of the company, and the e-mail address and company name do not match. what should shawn do?

Answers: 2

You know the right answer?

E21-8 (l02,4) excel (lessor entries; sales-type lease) crosley company, a machinery dealer, leased...

Questions

Business, 27.08.2020 14:01

Health, 27.08.2020 14:01

Mathematics, 27.08.2020 14:01

Mathematics, 27.08.2020 14:01

Mathematics, 27.08.2020 14:01

Mathematics, 27.08.2020 14:01

Chemistry, 27.08.2020 14:01

Computers and Technology, 27.08.2020 14:01

World Languages, 27.08.2020 14:01

English, 27.08.2020 14:01

Mathematics, 27.08.2020 14:01

English, 27.08.2020 14:01

English, 27.08.2020 14:01

History, 27.08.2020 14:01

Spanish, 27.08.2020 14:01