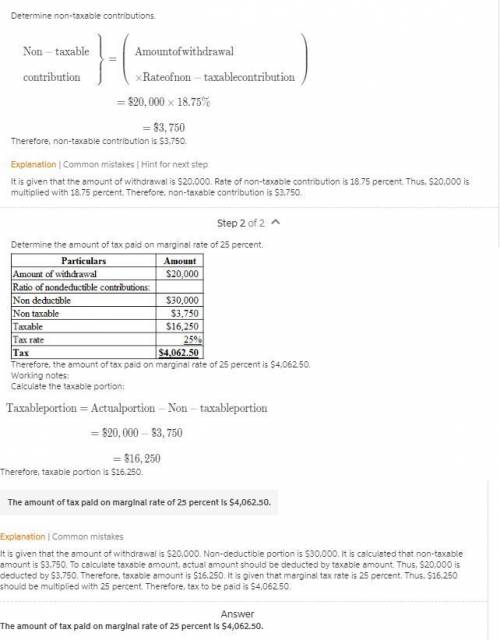

In 2019, rashaun (62 years old) retired and planned on immediately receiving distributions (making withdrawals) from his traditional ira account. the balance of his ira account is $160,000 (before reducing it for withdrawals/distributions described below). over the years, rashaun has contributed $40,000 to the ira. of his $40,000 contributions, $30,000 was nondeductible and $10,000 was deductible. assume rashaun did not make any contributions to the account during 2019.a. if rashaun currently withdraws $20,000 from the ira, how much tax will he be required to pay on the withdrawal if his marginal tax rate is 25 percent?

Answers: 1

Another question on Business

Business, 21.06.2019 22:50

Synovec co. is growing quickly. dividends are expected to grow at a rate of 24 percent for the next three years, with the growth rate falling off to a constant 7 percent thereafter. if the required return is 11 percent, and the company just paid a dividend of $2.05, what is the current share price? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers: 2

Business, 22.06.2019 11:10

Wilson company paid $5,000 for a 4-month insurance premium in advance on november 1, with coverage beginning on that date. the balance in the prepaid insurance account before adjustment at the end of the year is $5,000, and no adjustments had been made previously. the adjusting entry required on december 31 is: (a) debit cash. $5,000: credit prepaid insurance. $5,000. (b) debit prepaid insurance. $2,500: credit insurance expense. $2500. (c) debit prepaid insurance. $1250: credit insurance expense. $1250. (d) debit insurance expense. $1250: credit prepaid insurance. $1250. (e) debit insurance expense. $2500: credit prepaid insurance. $2500.

Answers: 1

Business, 22.06.2019 11:50

Christopher kim, cfa, is a banker with batts brothers, an investment banking firm. kim follows the energy industry and has frequent contact with industry executives. kim is contacted by the ceo of a large oil and gas corporation who wants batts brothers to underwrite a secondary offering of the company's stock. the ceo offers kim the opportunity to fly on his private jet to his ranch in texas for an exotic game hunting expedition if kim's firm can complete the underwriting within 90 days. according to cfa institute standards of conduct, kim: a) may accept the offer as long as he discloses the offer to batts brothers.b) may not accept the offer because it is considered lavish entertainment.c) must obtain written consent from batts brothers before accepting the offer.

Answers: 1

Business, 22.06.2019 14:40

Which of the following would classify as a general education requirement

Answers: 1

You know the right answer?

In 2019, rashaun (62 years old) retired and planned on immediately receiving distributions (making w...

Questions

English, 29.06.2019 08:00

Mathematics, 29.06.2019 08:00

English, 29.06.2019 08:00

Mathematics, 29.06.2019 08:00

Biology, 29.06.2019 08:00

History, 29.06.2019 08:00

Mathematics, 29.06.2019 08:00

English, 29.06.2019 08:00

Mathematics, 29.06.2019 08:00

Chemistry, 29.06.2019 08:00