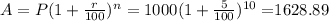

Suppose a state of new york bond will pay $1,000 ten years from now.

if the going intere...

Business, 09.12.2019 21:31 kordejah348

Suppose a state of new york bond will pay $1,000 ten years from now.

if the going interest rate on these 10-year bonds is 5.0%, how much is the bond worth today?

Answers: 3

Another question on Business

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 09:00

Afood worker has just rinsed a dish after cleaning it.what should he do next?

Answers: 2

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 14:30

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

You know the right answer?

Questions

SAT, 05.10.2021 15:30

Physics, 05.10.2021 15:30

Mathematics, 05.10.2021 15:30

Chemistry, 05.10.2021 15:30

Biology, 05.10.2021 15:30

Mathematics, 05.10.2021 15:30

English, 05.10.2021 15:30

Mathematics, 05.10.2021 15:30

Mathematics, 05.10.2021 15:30

Mathematics, 05.10.2021 15:30