Doug’s custom construction company is considering three new projects, each requiring an equipment investment of $22,000. each project will last for 3 years and produce the following net annual cash flows.

year aa bb cc

1 $7,000 $10,000 $13,000

2 9,000 10,000 12,000

3 12,000 10,000 11,000

total $28,000 $30,000 $36,000

the equipment’s salvage value is zero, and doug uses straight-line depreciation. doug will not accept any project with a cash payback period over 2 years. doug’s required rate of return is 12%. click here to view pv table.

(a)

compute each project’s payback period. (round answers to 2 decimal places, e. g. 15.25.)

aa entry field with correct answer years

bb entry field with correct answer years

cc entry field with correct answer years

which is the most desirable project?

the most desirable project based on payback period is entry field with correct answer project aaproject bbproject cc

which is the least desirable project?

the least desirable project based on payback period is entry field with correct answer project bbproject aaproject cc

(b)

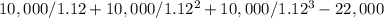

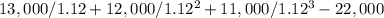

compute the net present value of each project. (enter negative amounts using either a negative sign preceding the number e. g. -45 or parentheses e. g. (45). round final answers to the nearest whole dollar, e. g. 5,275. for calculation purposes, use 5 decimal places as displayed in the factor table provided.)

aa entry field with incorrect answer now contains modified data

bb entry field with incorrect answer now contains modified data

cc entry field with incorrect answer now contains modified data

which is the most desirable project based on net present value?

the most desirable project based on net present value is entry field with correct answer project bbproject aaproject cc.

which is the least desirable project based on net present value?

the least desirable project based on net present value is entry field with correct answer project aaproject ccproject bb.

Answers: 1

Another question on Business

Business, 22.06.2019 01:50

Atlas manufacturing produces a unique valve, and has the capacity to produce 50,000 valves annually. currently atlas produces 40,000 valves and is thinking about increasing production to 45,000 valves next year. what is the most likely behavior of total manufacturing costs and unit manufacturing costs given this change? a. total manufacturing costs will increase and unit manufacturing costs will also increase. b. total manufacturing costs will stay the same and unit manufacturing costs will stay the same. c. total manufacturing costs will increase and unit manufacturing costs will decrease. d. total manufacturing costs will increase and unit manufacturing costs will stay the same.

Answers: 1

Business, 22.06.2019 08:50

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 16:40

Differentiate between the trait, behavioral, and results-based performance appraisal systems, providing an example where each would be most applicable.

Answers: 1

You know the right answer?

Doug’s custom construction company is considering three new projects, each requiring an equipment in...

Questions

History, 15.12.2020 22:50

English, 15.12.2020 22:50

Physics, 15.12.2020 22:50

Spanish, 15.12.2020 22:50

Mathematics, 15.12.2020 22:50

Biology, 15.12.2020 22:50

World Languages, 15.12.2020 22:50

Computers and Technology, 15.12.2020 22:50

Business, 15.12.2020 22:50

Mathematics, 15.12.2020 22:50

English, 15.12.2020 22:50