Business, 04.12.2019 03:31 xwilliams83

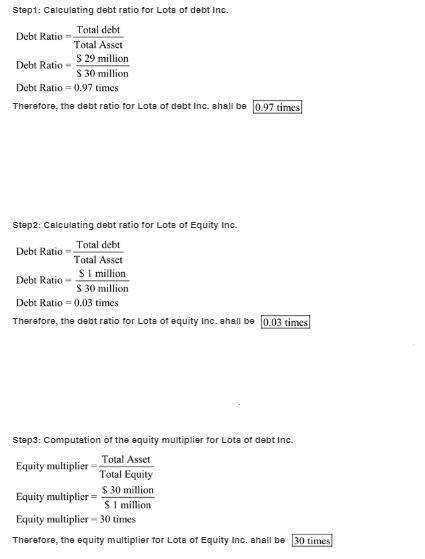

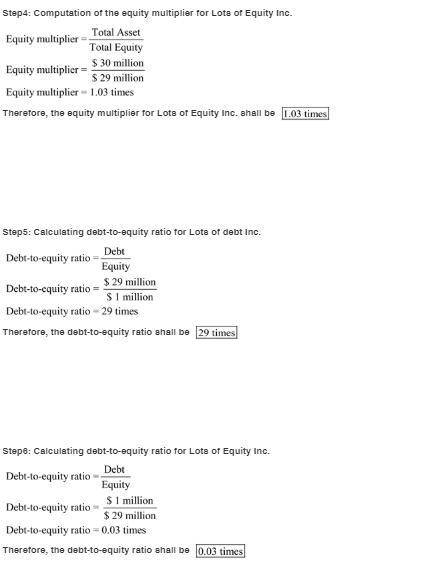

Debt management ratios you are considering a stock investment in one of two firms (lotsofdebt, inc. and lotsofequity, both of which operate in the same industry. lotsofdebt, inc. finances its $30 million in assets with $29 million in debt and $1 million in equity. lotsofequity, inc. finances its $30 million in assets with $1 million in debt and $29 million in equity. calculate the debt ratio and equity multiplier for the two firms.

Answers: 3

Another question on Business

Business, 21.06.2019 17:10

At the beginning of the accounting period, nutrition incorporated estimated that total fixed overhead cost would be $50,600 and that sales volume would be 10,000 units. at the end of the accounting period actual fixed overhead was $56,100 and actual sales volume was 11,000 units. nutrition uses a predetermined overhead rate and a cost plus pricing model to establish its sales price. based on this information the overhead spending variance is multiple choice $5,500 favorable. $440 favorable. $5,500 unfavorable. $440 unfavorable.

Answers: 3

Business, 21.06.2019 20:00

Which financial component is a mandatory deduction from your gross pay? a. sales tax b. social security tax c. health insurance d. disaster relief fund (drf) e. voluntary deduction

Answers: 1

Business, 21.06.2019 20:00

Which is not an example of a cyclical company? a) airlines b) hotel industry c) medical d) theme parks

Answers: 1

Business, 22.06.2019 01:10

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

You know the right answer?

Debt management ratios you are considering a stock investment in one of two firms (lotsofdebt, inc....

Questions

Biology, 12.01.2021 17:30

Social Studies, 12.01.2021 17:30

Mathematics, 12.01.2021 17:30

Social Studies, 12.01.2021 17:30

Mathematics, 12.01.2021 17:30

Mathematics, 12.01.2021 17:30