Business, 30.11.2019 06:31 tasa123l14

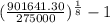

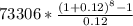

Boomer biscuit inc. needs to automate its production line. the project costs $275,000 and is expected to provide after-tax cash flows of $73,306 for eight years. management estimates its cost of capital as 12 percent. what is the project’s mirr? (do not round intermediate computations. round final answer to the nearest whole percent.)

a. 14%

b. 16%

c. 18%

d. 12%

Answers: 3

Another question on Business

Business, 22.06.2019 16:40

Determine the hrm’s role in the performance management process and explain how to ensure the process aligns with the organization’s strategic plan.

Answers: 1

Business, 22.06.2019 20:40

Helen tells her nephew, bernard, that she will pay him $100 if he will stop smoking for six months. helen was hopeful that if bernard stopped smoking for six months, he would stop altogether. bernard stops smoking for six months but then resumes his smoking. helen will not pay him. she says that the type of promise she made cannot constitute a binding contract and that, furthermore, it was at least implied that he would stop smoking for good. can bernard legally collect $100 from helen

Answers: 1

Business, 22.06.2019 22:30

Selected information about income statement accounts for the reed company is presented below (the company's fiscal year ends on december 31): 2018 2017sales $ 4,400,000 $ 3,500,000cost of goods sold 2,860,000 2,000,000administrative expenses 800,000 675,000selling expenses 360,000 312,000interest revenue 150,000 140,000interest expense 200,000 200,000loss on sale of assets of discontinued component 50,000 —on july 1, 2018, the company adopted a plan to discontinue a division that qualifies as a component of an entity as defined by gaap. the assets of the component were sold on september 30, 2018, for $50,000 less than their book value. results of operations for the component (included in the above account balances) were as follows: 1/1/18-9/30/18 2017 sales $ 400,000 $ 500,000 cost of goods sold (290,000 ) (320,000 )administrative expenses (50,000 ) (40,000 )selling expenses (20,000 ) (30,000 )operating income before taxes $ 40,000 $ 110,000 in addition to the account balances above, several events occurred during 2018 that have not yet been reflected in the above accounts: a fire caused $50,000 in uninsured damages to the main office building. the fire was considered to be an infrequent but not unusual event.inventory that had cost $40,000 had become obsolete because a competitor introduced a better product. the inventory was sold as scrap for $5,000.income taxes have not yet been recorded.required: prepare a multiple-step income statement for the reed company for 2018, showing 2017 information in comparative format, including income taxes computed at 40% and eps disclosures assuming 300,000 shares of common stock. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 3

Business, 22.06.2019 23:00

The quinoa seed is in high demand in wealthier countries such as the u.s. and japan. approximately 97% of all quinoa production comes from small farmers in bolivia and peru who farm at high elevations—8,000 feet or higher. the seed is considered highly nutritious. mostly grown and harvested in bolivia and peru, and sold to markets in other countries, the seed is now considered an important for these nations. the governments of bolivia and peru are hopeful that this product will increase the quality of life of their farmers.

Answers: 3

You know the right answer?

Boomer biscuit inc. needs to automate its production line. the project costs $275,000 and is expecte...

Questions

English, 14.01.2021 17:40

Mathematics, 14.01.2021 17:40

Geography, 14.01.2021 17:40

Mathematics, 14.01.2021 17:40

English, 14.01.2021 17:40

Mathematics, 14.01.2021 17:40

History, 14.01.2021 17:40

Mathematics, 14.01.2021 17:40

Mathematics, 14.01.2021 17:40

............1

............1

................2

................2