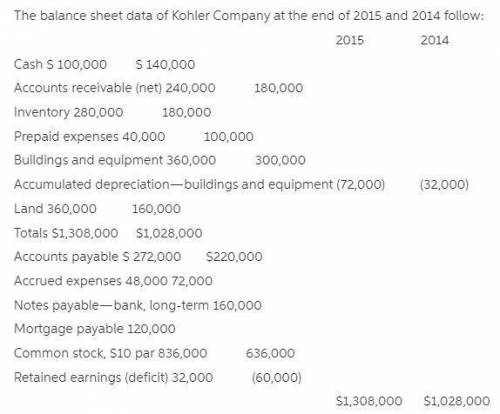

Land was acquired for $200,000 in exchange for common stock, par $200,000, during the year; all equipment purchased was for cash. equipment costing $20,000 was sold for $8,000; book value of the equipment was$16,000 and the loss was reported as an ordinary item in net income. cash dividends of $40,000 were charged to retained earnings and paid during the year; the transfer of net income to retained earnings was the only other entry in the retained earnings account. in the statement of cash flows for the year ended december 31,2015, for naley company: 1. the net cash provided by operating activities wasa) $104,000.b) $132,000.c) $112,000.d) $96,000.

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

What is the relationship between marginal external cost, marginal social cost, and marginal private cost? a. marginal social cost equals marginal private cost plus marginal external cost. b. marginal private cost plus marginal social cost equals marginal external cost. c. marginal social cost plus marginal external cost equals marginal private cost. d. marginal external cost equals marginal private cost minus marginal social cost. marginal external cost a. is expressed in dollars, so it is not an opportunity cost b. is an opportunity cost borne by someone other than the producer c. is equal to two times the marginal private cost d. is a convenient economics concept that is not real

Answers: 3

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 23.06.2019 06:00

Before setting your prices, it's wise to a. subtract your profit margin from your costs. b. research industry standards. c. memorize the formula for cost plus. d. ignore your competitors' prices.

Answers: 1

You know the right answer?

Land was acquired for $200,000 in exchange for common stock, par $200,000, during the year; all equ...

Questions

Mathematics, 20.12.2019 01:31

Biology, 20.12.2019 01:31

History, 20.12.2019 01:31

Biology, 20.12.2019 01:31

Social Studies, 20.12.2019 01:31

Chemistry, 20.12.2019 02:31