Business, 30.11.2019 02:31 halobry2003

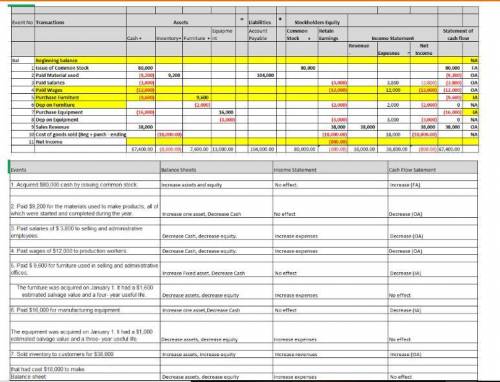

Gunn manufacturing company experienced the following accounting events during its first year of operation. with the exception of the adjusting entries for depreciation, assume that all transactions are cash transactions.

1. acquired $80,000 cash by issuing common stock.

2. paid $9,200 for the materials used to make its products, all of which were started and completed during the year.

3. paid salaries of $3,800 to selling and administrative employees.

4. paid wages of $12,000 to production workers.

5. paid $9,600 for furniture used in selling and administrative offices. the furniture was acquired on january 1. it had a $1,600 estimated salvage value and a four-year useful life.

6. paid $16,000 for manufacturing equipment. the equipment was acquired on january 1. it had a $1,000 estimated salvage value and a five-year useful life.

7. sold inventory to customers for $38,000 that had cost $18,000 to make.

required:

show how these events would affect the balance sheet, income statement, and statement of cash flows by recording them in a horizontal financial statements model as indicated here. also, in the cash flow column, indicate whether the cash flow is for operating activities (oa), investing activities (ia), or financing activities (fa). use na to indicate that an element is not affected by the event. the first event is recorded as an example. (enter any decreases to account balances and cash outflows with a minus sign.)

Answers: 3

Another question on Business

Business, 22.06.2019 16:30

Penelope summers received certain income benefits in 2018. she received $1,400 of state unemployment insurance benefits, $2,000 from a federal unemployment trust fund and $3,700 workers’ compensation received for an occupational injury. what amount of the compensation must penelope include in her income

Answers: 1

Business, 22.06.2019 17:00

Zeta corporation is a manufacturer of sports caps, which require soft fabric. the standards for each cap allow 2.00 yards of soft fabric, at a cost of $2.00 per yard. during the month of january, the company purchased 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. what is zeta corporation's materials price variance for the month of january?

Answers: 2

Business, 22.06.2019 21:30

Which of the following best explains the purpose of protectionist trade policies such as tariffs and subsidies? a. they make sure that governments have enough money to pay for fiscal policies. b. they give foreign competitors access to new markets around the world. c. they allow producers to sell their products more cheaply than foreign competitors. d. they enable producers to purchase productive resources from everywhere in the world.

Answers: 1

Business, 22.06.2019 22:00

What resourse is both renewable and inexpensive? gold coal lumber mineral

Answers: 1

You know the right answer?

Gunn manufacturing company experienced the following accounting events during its first year of oper...

Questions

Geography, 08.04.2020 00:23

Mathematics, 08.04.2020 00:23

Physics, 08.04.2020 00:23

Mathematics, 08.04.2020 00:24

Biology, 08.04.2020 00:24

English, 08.04.2020 00:24

Chemistry, 08.04.2020 00:24