Business, 30.11.2019 02:31 JuanTorres7

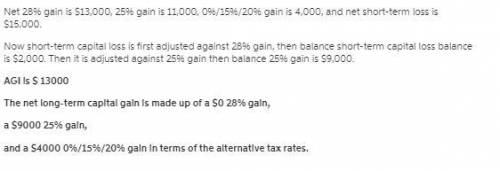

Wilmont has the following long-term capital gains and losses for 2019: $37,000 28% gain, $24,000 28% loss, $11,000 25% gain, and $4,000 0%/15%/20% gain. he also has a $55,000 short-term loss and a $40,000 short-term gain. he has no other income. if an amount is zero, enter "0". what is wilmont's agi from these transactions? if he has a net long-term capital gain, what is its makeup in terms of the alternative tax rates?

Answers: 3

Another question on Business

Business, 22.06.2019 20:40

Helen tells her nephew, bernard, that she will pay him $100 if he will stop smoking for six months. helen was hopeful that if bernard stopped smoking for six months, he would stop altogether. bernard stops smoking for six months but then resumes his smoking. helen will not pay him. she says that the type of promise she made cannot constitute a binding contract and that, furthermore, it was at least implied that he would stop smoking for good. can bernard legally collect $100 from helen

Answers: 1

Business, 22.06.2019 22:20

Who owns a renter-occupied apartment? a. the government b. a landlord c. the resident d. a cooperative

Answers: 1

Business, 22.06.2019 22:30

Suppose that each country completely specializes in the production of the good in which it has a comparative advantage, producing only that good. in this case, the country that produces jeans will produce million pairs per week, and the country that produces corn will produce million bushels per week.

Answers: 1

You know the right answer?

Wilmont has the following long-term capital gains and losses for 2019: $37,000 28% gain, $24,000 28...

Questions

Computers and Technology, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Business, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00

Mathematics, 27.10.2020 01:00